William Mills Agency and Beyond the Arc will be live blogging at FinovateSpring 2016. Check back for new updates throughout the day.

#finovate Tweets07:14 pm

Well folks, 35 companies today, 35 tomorrow and now we are off to visit with this afternoon’s presenters. We MIGHT have some video from San Jose so check back soon. If you would like to Tweet, share, link or use any content from this blog feel free to although we’d appreciate it if you would spread the word about William Mills Agency.

William Mills Agency is North America’s largest FinTech public relations and marketing agency with our 35 associates representing 60 clients around the globe. Feel free to reach me at william@williammills.com.

See you tomorrow!

^William Mills

07:10 pm

WealthForge – @WealthForge – https://www.wealthforge.com/

Arthur Weissman (Head of Sales)

Mat Dellorso (Chief Strategy Officer & Co-Founder)

Demo: Dynamic Tombstones

Anyone raising public capital, allows for advertising on any website, anywhere.

Login, enter some information, add in documents, etc.. As you are entering the information, a tombstone is being created for you to review. Once you click submit all the information goes to Wealthforge for accuracy. Then they will create a single of code where you can place on your website or even an email. Then the visitor to your website can click through the tombstone for more information and invest from there. Also built network with advisors, etc. for the companies raising capital. Hmm, a Finovate presenter who is selling to Finovate presenters. ^KT

Private capital markets are inefficient for investors and entrepreneurs. They provide a vehicle to market your equity offering on any website, in a safe and compliant way. “Digital tombstones” are the ad units that they manage across a range of sites. As a young startup, WealthForge has been very successful in helping companies to raise capital with over 200 capital raises to date. ^SR

07:02 pm

Neustar – @Neustar – https://www.neustar.biz/marketing-solutions

Andrew Artemenko (Sr. Director, Digital Strategy)

Marketing platform for Banks – Targeted advertising based on target audience.

Marketers have to understand where does my next customer come from? So, with Neustar Platform One, you can build an audience and then go back to stakeholders and explain who your audience is and how you are going to go after them.

Platform One can tell you how many of your top customers you can find on the top advertising platforms. To begin, you add in your existing customers, personal finance accounts, etc. and then see which inventory (advertiser) provider has the best estimated reach for your customers. Then gives you data geographically or even how many ad impressions does it take for them to convert to a customer. ^KT

This is the year of big data and analytics, applied to the field of financial services. For Neustar, they apply analytics to digital marketing. Now you can make data-driven decisions when it comes to marketing and segmentation. Answers: where does my next best customer come from? You can also track your target audiences in real-time, to see what content (and ads) they are interacting with. The platform indicates how many impressions it takes before someone will convert. ^SR

06:55 pm

Mitek – @MitekSystems – https://www.miteksystems.com/

Sarah Clark (General Manager, Identity)

Steve Craig (Director, Products & Experience)

Product: Mobile Verify

Enables end-user experience where mobile app user can take image of driver’s license and instantly tell you the authenticity. – This is a native app.

Now, have worked on the browser experience.

Demo: Student application for a credit card. Verify ID – sends verification to mobile where they can take a picture of their ID. Software doesn’t just take the picture but their is computer vision that runs in the browser to tell instantly if the image isn’t optimized the best. Then sends user back to browser.

Can see the verification data to know that the data that was entered from the image is a perfect match and a true ID. Then second verification method is that the device is owned by the contact. ^KT

Mitek is a clear leader in the field of identity verification. They have amazing image recognition technology. Every year at Finovate they come up with unique applications of their core technology. In this demo, they help to authenticate a user (with photo ID), and associate that to their mobile device. As a credit card applicant, the issuer would know that you are who you say you are, with a known mobile device. Now they have 2-factor authentication, based on the device. Cool! ^SR

06:47 pm

Quid – @Quid – https://quid.com/

Lowell Doppelt (VP, Sales)

Sarah Pilewski (Principal)

Helping you understand

So, what if you wanted to understand what’s going on with ApplePay.

Many of us use Google to understand but most don’t go past page 1 to really understand applepay beyond the product or the wikipedia page. Quid – helps you understand apple pay with a visual representation.

For example – the CFPB. You can export the data straight from CFPB, upload the info into Quid. Quid would read through the consumer complaints and identify the main topics and pain points. Then you see a visualization bucketed into the most important topics by colors. Can see the topic companies being complained about in a bar graph or which organizations may be over represented.

It’s a pretty neat visualization of data. ^KT

Is it time to update the process of business research? Quid thinks so. They want you to be able to understand complex content. Looks like a tool to explore and visualize unstructured text data. They are using their tool to analyze consumer complaints from the CFPB. ^SR

06:40 pm

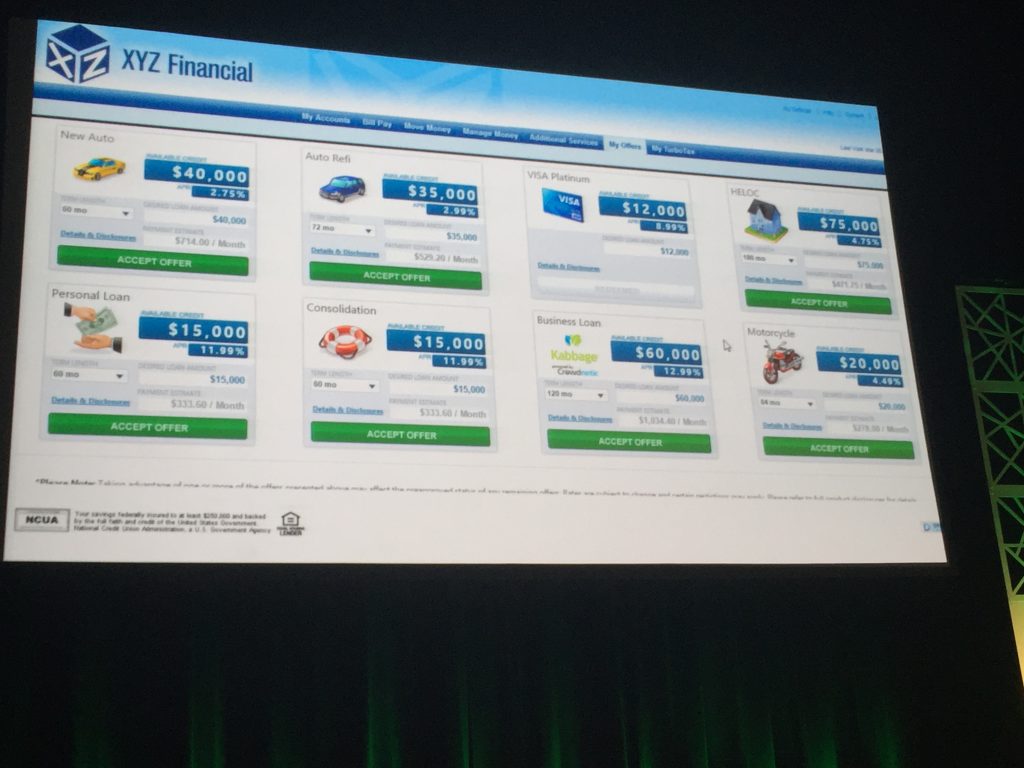

CUneXus – @CUneXUS – http://cunexusonline.com/

Dave Buerger (CEO, President & Co-Founder)

John Reich (CTO & Co-Founder)

Showing auto lending technology.

Demo: Mobile banking app of client DCU. Pushing alerts to consumers about their approval for a pre-approved auto loan. They click through and it will open their mobile banking app. You have the option to “Find your car” When searching for cars, it will bring up local real-time inventory with the price, estimated loan amount, estimated monthly payment. Full shopping and research experience without ever leaving the banking app. This is really useful. I am looking to buy a car soon, this would take out a lot of the work searching on multiple sites trying to find the right car at the right price at the right loan amount and monthly payment. ^KT

They are demoing adding “auto express” product to bank partners’ mobile banking apps. Auto lending has lagged in using mobile tech, CUneXUS is filling that gap. They have a partnership with Edmunds.com. Real time auto inventories are incorporated into the mobile experience. Pre-approved loans and pre-negotiated car prices — very solid idea, with a lot of benefit for consumers. For banks, the customer never leaves the bank’s mobile banking app. ^SR

06:33 pm

Vera Security – @verasecurity – https://www.vera.com/

Ajay Arora (CEO & Co-Founder)

Grant Shirk (Sr. Director, Product Marketing)

Imagine a world…. Where you control your data everywhere.

Demo: Take FI information such as excel and PDF. Drag and attach items to email, Vera sees the files and asks if you want to secure and watermark them. You secure it and then send it. From an end-user perspective, they receive the email and they can see all the content but they are locked from editing, copying or printing it.

Can track everywhere the file has gone. Slack is really popular in FIs and integrates with Slack. So you get a notification if you post an insecure file with a suggestion to secure it with a click of a button. ^KT

Vera enables you to add security to ordinary files, like Excel. Those permissions follow the file, no matter how you share it. So, if someone obtains the file, they can’t open it. But you don’t need to add a password to every file. You can monitor everywhere the file has been shared. There are new integrations, for example with collaboration tool Slack. You get control of your data and files, everywhere. Also restricts ability to take screenshots of sensitive files! ^SR

06:25 pm

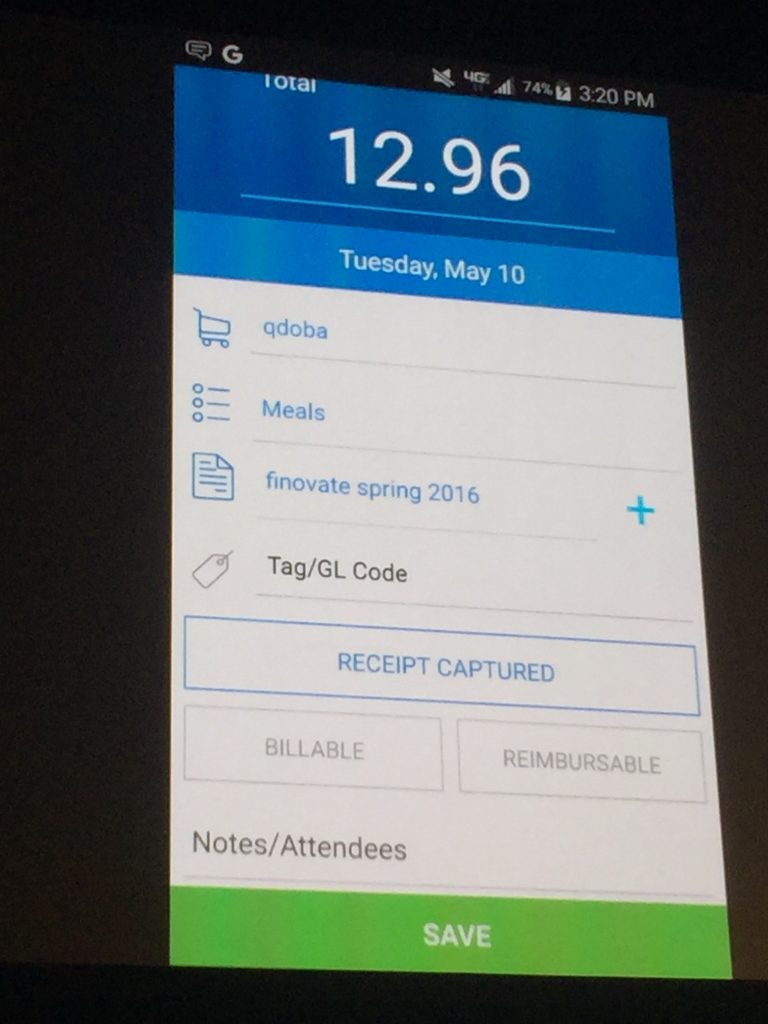

Obloco – @oblo_co – http://oblo.co/

Victor Yefremov (CEO)

Sam Fleming (CTO)

First white-label expense report solution for FIs. Airfare in email, meal receipts in wallet. Expense reports are inconvenient and SUCK. Today small business customers can capture, create and manage expense reports in a place they already trust, their banking platform. This is for Banks to provide to their small business customers. Take images of receipts, etc. and tag for the category and add to report. Simple and intuitive. ^KT

This is a simple tool for small business to collect and manage expense reports and receipts. Not trying to compete with Concur or provide complex approval workflows. ^SR

06:17 pm

Finovera – @finovera – https://www.finovera.com/

Finovera – @finovera – https://www.finovera.com/

Purna Pareek (CEO)

Amanda Zepeda (Marketing Manager)

Digital Banking Payment and bill management platform. Help banks and CUs take their bill pay and turn into a personal finance destination.

Bill-pay becomes a revenue generator for Banks. Demo: shows upcoming bills where you can see your bill status and PDF bills. Can pay bills using credit card through the Banks website. Okay, cool. I always like to get points on my credit card. This way I could pay through the Banks website but get the points as well. Nice. ^KT

I’ve had the opportunity to meet CEO, Puma Pareek. Impressed with the team, seem to have a genuine passion for financial services and fintech. Finovera is offering eBill aggregation. You can use your phone to scan paper bills, and add to “digital file cabinet” from Finovera. “Bill management is the new bill pay.”^SR

06:11 pm

Savedroid – @SaveDroidAg – https://www.savedroid.com/

Yassin Hankir (CEO & Founder)

Marco Trautmann (COO & Founder)

Tobias Zander (CTO & Founder)

Stop wasting money and save it. Applies big data to analyze spending habits.

Demo: “Smooves” Smart savings move.

You create a wish like “My trip to Frankfurt” and then you set up savings settings to control your habits. I.e. time on facebook → goes to savings every time you go over your set amount of time? Interesting line of thinking…

Offers white label for banking. ^KT

A mobile app to help people spend wisely, and save money for the goals that are important in life. Targeted for younger people (college age?), uses big data to find savings on things you may want to purchase. E.g. Save 0 on your cell phone. You can connect day to day savings to specific goals. But really, do people really use these types of savings tools??? None have really gained traction, beyond perhaps Mint.com. ^SR

06:03 pm

Civic Technologies – https://www.civic.com/

Vinny Lingham (CEO)

Jonathan Smith (CTO)

New product unveiling – Real Time identity Alerts

Identity theft is a massive problem – Today you dont get alerts when someone uses your identity. Civic has created this. Showing a standard credit card information form. You will get a notification on your phone and can authorize or decline to ensure it is you in the transaction.

Emphasizing partner relationship to Finovate crowd to help distribute it. ^KT

Civic provides real-time identity alerts, to keep your personal info secure. This offering gives the customer a notification via the mobile app, before an application is processed or credit report is run. For partners, they have a developer portal and API. Consumer launch is coming shortly. Civic has 2 products, one of them free. The authentication service is the one they’ll charge for. ^SR

05:23 pm

CRMNEXT – @CRMNext – http://www.crmnext.com/ – Joe Salesky (CEO, North America)

and Ed Ponte (VP, Sales Consulting)

I know Joe, he did great with a VERY early mobile banking company, he’s a good person that knows the industry. He did a demonstration at the first Finovate 10 years ago in New York (I was there but had to sit in the overflow room). He is now showing a new account opening screen (with another fantastic UI). “80% of your customer interaction is mobile, shouldn’t your CRM be mobile as well.” Showing the workflow for their online account opening in a drag and drop tool. Very slick. Could be used in a branch, call center or on-site. Integrated with 100+ back end systems. These folks are bringing 21st technologies to FI’s across all channels.

Great presentation.

^William

CRMNEXT is integrating CRM into the online and mobile account opening processes. Something like changing an address (which isn’t always so simple on the back end!), is made very simple by CRM. CEO Joe Salesky (@jsalesky) always has great insights on Twitter, and a very nice presentation this afternoon. ^SR

05:11 pm

Fintonic – @fintonic – https://www.fintonic.com/app/landing/home.do Sergio Chalbaud (CEO)

Most used mobile banking app in Spain, now bringing to the US.

^WM

Quick and easy loan processing via mobile banking app. Currently in the market in Chile, looking to come to the US. ^SR

05:08 pm

WorthFM – @worthfm – https://www.worthfm.com/ – Amanda Steinberg (CEO & Co-Founder)

Amanda is showing the enhanced Robo-advisor and cash management for affluent women. All client’s ave savings, investment and retirement accounts. Like a Google Now for your money. This is a unique Finovate presentation. I don’t think I’ve seen (or remembered) a FinTech demo designed for (and by) women only. Very good user experience.

^William

Specialized wealth management offering for mass affluent women– what a great idea! The services opens 3 accounts for women: investment, savings, retirement. Auto-saving can be established between accounts. The system makes recommendations for how to manage her money. They’ve identified 5 investor profiles. The way they advice is provided varies based on this profile. Some people get short explanations, but inspirational guidance. Not different advice, but advice delivered differently. Today is the unveiling of the new product. As a robo-advisor, they have a very unique take on the market and a breakthrough offering. ^SR

05:01 pm

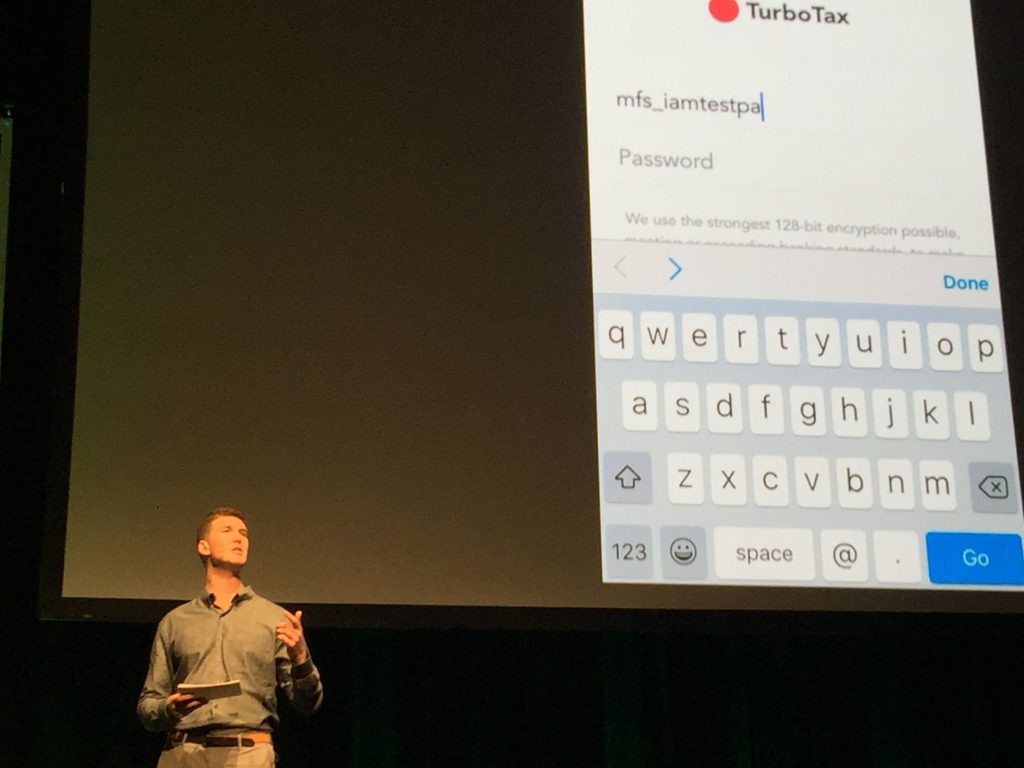

Roostify – @roostify – https://www.roostify.com/ Nathaniel Sokoll-Ward (Head of Product) and Jonathan Kirst (CTO)

Mortgage technology. Let me tell you, the mortgage side of the FI has really lagged in mobile technology after the great recession so I’m listening. I do like their name. Showing their mobile app connected to TurboTax via Equifax. Connects to virtually any FI in the country. I need to learn more about these folks. “You will never have to ask your borrowers for paper information.” Sounds good to me. Customized to their client so I’m assuming private label. Very cool.

^William

Demoing their fully self-service lending experience. By connecting to Intuit, they show pre-populating key data so customer does not have to type it. So, the process can be completed on a phone. With the W2 from TurboTax, they can verify personal financial information. The credit report is run, and via an API, the mobile app can serve up loan products and pricing. ^SR

04:55 pm

SaleMove – @salemove – https://www.salemove.com/ Daniel Michaeli (CEO)

The user interfaces keep getting better and better. I like what he said “it should be as easy to “”walk”” around a web site as it is to walk around a financial institution.” Showing use case with video conference with agent. Showed the program on the customer side; getting ready to show the business side. “Secure. Scaleable. Seamless.”

^WilliamEasy to add co-browsing and other digital features, to make it easy for customer to interact with your FI. They offer integration directly with your CRM system. Very focused on the user experience. You can use the online tool to see what the function would look like on your own site. ^SR

04:46 pm

BanQu – @BanQuApp – http://www.banquapp.com/ Ashish Gadnis (CEO & Founder) and Hamse Warfa (EVP & Founder)

This is an IMPORTANT solution to a world-wide problem. These folks use Blockchain-based technology to valid REAL identities. These is important because people in the U.S. that NEED to send money home to third-world countries but often can’t due to Know Your Customer regulations. Governments don’t want money to go to “bad guys” so often badly-needed money can’t make it to family and friends for food and medicine. The BanQu network now lets the right money go to the right people, world-wide. I really like these folks.

^William

Millions of people around the world live with no identity papers, so can’t access financial services. Think about refugees fleeing a country. Oops, left their driver’s license behind. This selfie-based system creates a digital signature. The data, both identity and transactions, is tracked via a unique application of blockchain tech. This identity profile makes it easier to confirm that aid gets to the people who need it. This has got to be one of the best applications I’ve seen of blockchain! ^SR

04:38 pm

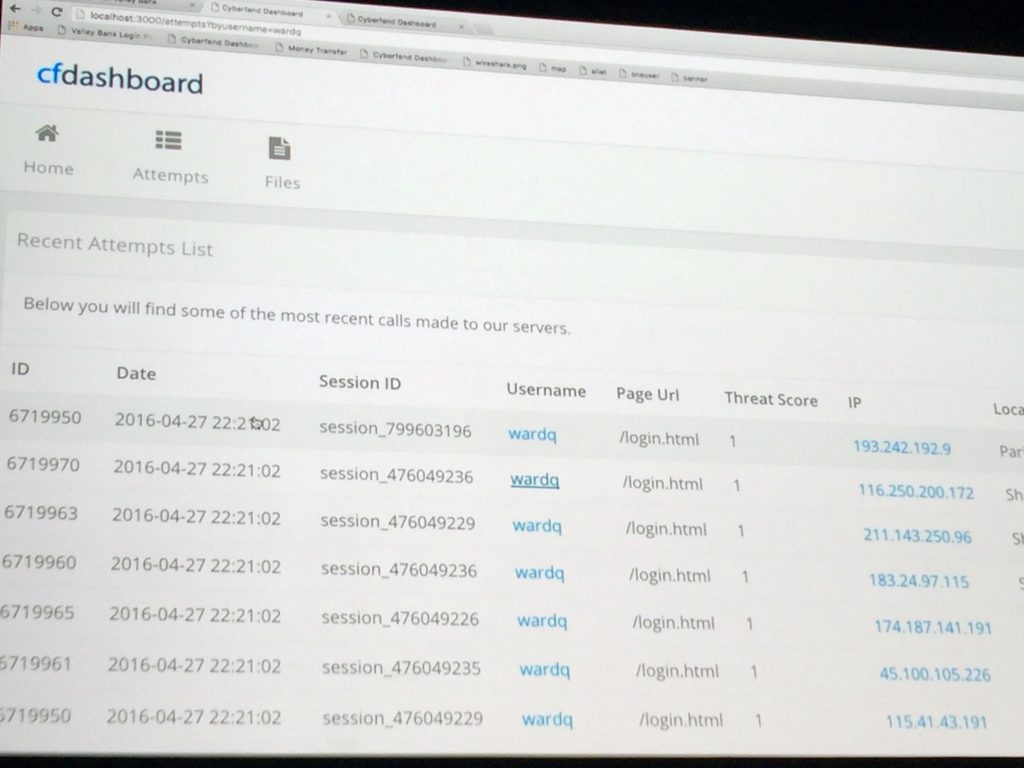

Cyberfend – https://cyberfend.com/ – Sreenath Kurupati (CEO & Co-Founder)

The company says they protect 100 million of users across the globe. Getting ready to show simulated API attack. Using free tool (which I’ve tested) called WireShark to study web traffic. Kind of technical but I suspect pretty important. I’m no hacker but now and then I read 2600 Magazine for hackers. I like to try to understand how hackers think and they have some good articles.

Now showing data from the “dark web” for matches on usernames and passwords. CYBERFEND BLOCKS THIS TYPE OF ATTACK. Showing good dashboard of attempted computer attacks. “Hackers keep changing their tactics” Processing a billion transactions per month.

^William

Cyberfend helps companies protect against hacking attacks. Amazingly, the demo is showing us lines of code in a terminal window. But OK, they do actually have a dashboard. Whew! Cyberfend blocks transactions, and even broader cyber attacks. They are processing 1 billion transactions per month. ^SR

04:30 pm

IBM – @IBM – http://www.ibm.com/us-en/ and Rob Stanich (Global Wealth Mgmt. Offering Mgr.) Alex Baghdjian (Sr. Offering Assoc., Financial Markets & Wealth Management)

“We are a tech startup from New York” Good use of humor. First, API-based pre-built for the financial/wealth management industry. Showing “Advise” model – a financial planner scenario. I’m GUESSING it’s a browser-based solution, the UI is slick so it’s hard to tell the difference between an app and a browser-based solution.

IBM has sells (and has sold) billions (if not trillions) of dollars in technology products and services to financial institutions. I don’t know if it’s still true but back in the old days the IBM folks would “office” a dozens, if not hundreds of sales and support folks in each of the key big bank offices. I like seeing IBM at Finovate; so much innovation used to come out of the company and I’m hoping they continue to do so.

“Dynamic Segmentation” their machine-learning techniques to better help the financial advisor advise and provide better financial recommendations. Now showing management view.

^William

Industry-based analytics solutions, this one is for Wealth Management. It is a pre-built solution for predictive analytics. (Disclosure: Beyond the Arc is an IBM Business Partner in predictive analytics.) The user interface is similar to recent developments in Cognos Analytics and various IBM Watson offerings. In the demo, they are showing an attrition prediction. This product uses Watson technology to understand client preferences and behavior. Dynamic Segmentation: machine learning to discover clusters of clients. ^SR

04:20 pm

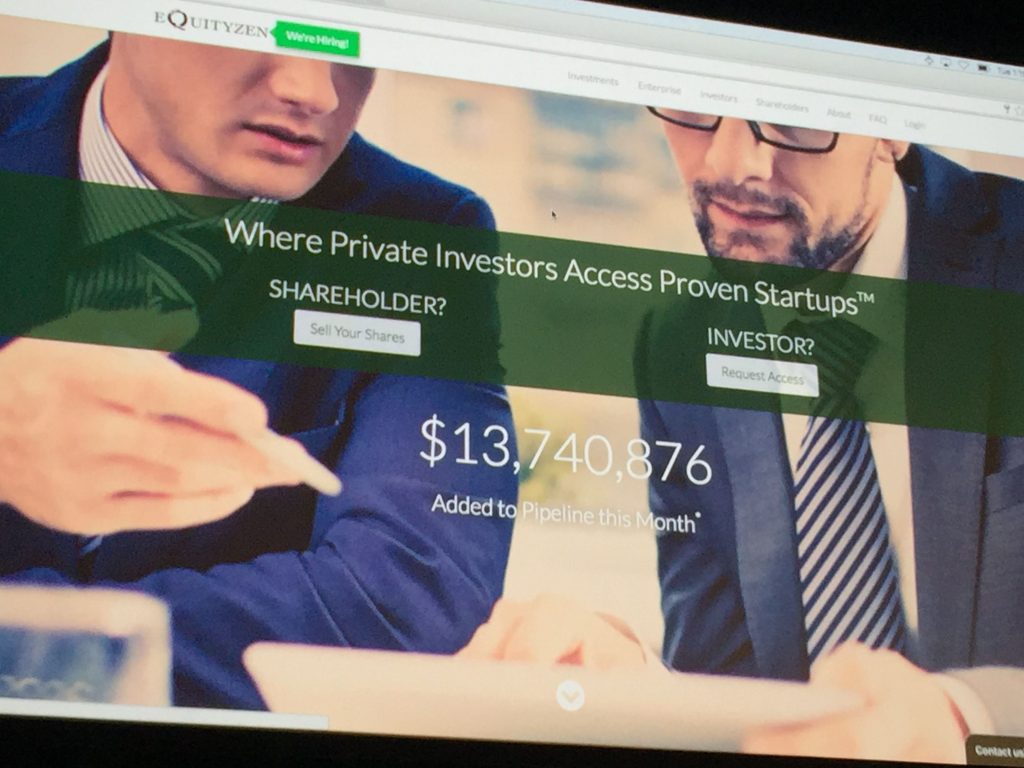

EquityZen – @EquityZen – https://equityzen.com/ Atish Davda (CEO & Founder)

and Ketan Bhalla (Product Lead)

“Private Markets 2.0” trading platform for company stock that is privately-held. This is HOT right now with the tech IPO window pretty much closed – there were ZERO tech IPO’s in the first quarter of this year. Launching EquityZen Institutional I imagine for financial planners to use instead of high net worth individuals.

^William

QuityZen provides a market for stock in private companies. This is a way for people to buy into startup unicorns that have not yet had their IPO. Very comprehensive investing information, including data on each round of financing. Minimum investment is k. This offering is now available as an institutional platform for advisors. They consider this to be “private markets 2.0.” ^SR

04:14 pm

OutsideIQ – @OutsideIQ – http://www.outsideiq.com/ Dan Adamson (CEO) and Joe Oswald (COO)

Due Diligence (DD) is the topic. “Year ago launched DDIQ to act like an investigator.” Showing use example of DDIQ in a computer browser (Chrome I think). Boy, Chrome is really getting popular with FinTech companies. Showing the DDIQ “pinging” a sheriff’s report on a person in question (a potential supplier). DDIQ is being used by 40 financial institutions. Launching a monitoring version of the service; like a “Google Alert on Steroids.”

^William

Their technology is useful for due diligence and investigations. You can create profiles for people and companies. They check regulatory watchlists, and then looks at unstructured web data. There product, DDIQ, is used by over 40 FIs. The company is now adding a near real-time alerts function. This is a way for banks to implement a “detect and monitor” program. ^SR

04:07 pm

#finovate is trending I believe.

04:00 pm

We are getting ready to get started again, stand by!

William

03:02 pm

Flybits – @FlyBitsInc – http://www.flybits.com/

Hossein Rahnama (Chief Product Officer & Founder)

Jerry Rudisin (CEO)

Flybits allows tools for FIs to build their own concierge services. Drag and drop functionality. Create rules that learn from the behavior of your customers. For example, if you want to offer a credit card offer to people who have a high credit score rating, you create a rule. It can become more complicated from there. ^KT

Flybits helps you to personalize your existing app. Banks build their own concierge services. With this platform, you can create your own digital customer experience moments. The tool is “moment builder”, I like the name. ^SR

02:55 pm

NCR – @NCRCorporation – http://www.ncr.com/

Kimberly Prieto (Dir., Bus. Dev. & Alliances)

Shuki Licht (Sr. Enterprise Architect)

What a powerful tool.

Imagine going to a game for the “Savannah Sharks.” Purchase tickets, parking pass etc, before the game. Once there, customer brings up the app which has all that information ready to go. Ticket is at the top of the game day app. As I walk through the stadium, app allows restaurants around the stadium, can pre-order it before getting the food. Get an offer for discount on craft beer. Then can skip line and pick-up order.

On the way home from the game, I get a transaction alert from my FI. From there login to my digital banking app and see the accounts and drill into the checking account. If you click through, you can see line item detail of what I purchased – beer, chips, sandwich, etc. If you click through will give you data on how much you have spent on that one item. Can look at offers near me as well.

All of these experiences are built by the same NCR platform. FIs can use vast amount of data to provide customers with an offer. Very Powerful. ^KT

The app provides deep insights into consumer spending, with data drawn from an ecosystem that NCR has created. Consumers get insights, too. ^SR

02:49 pm

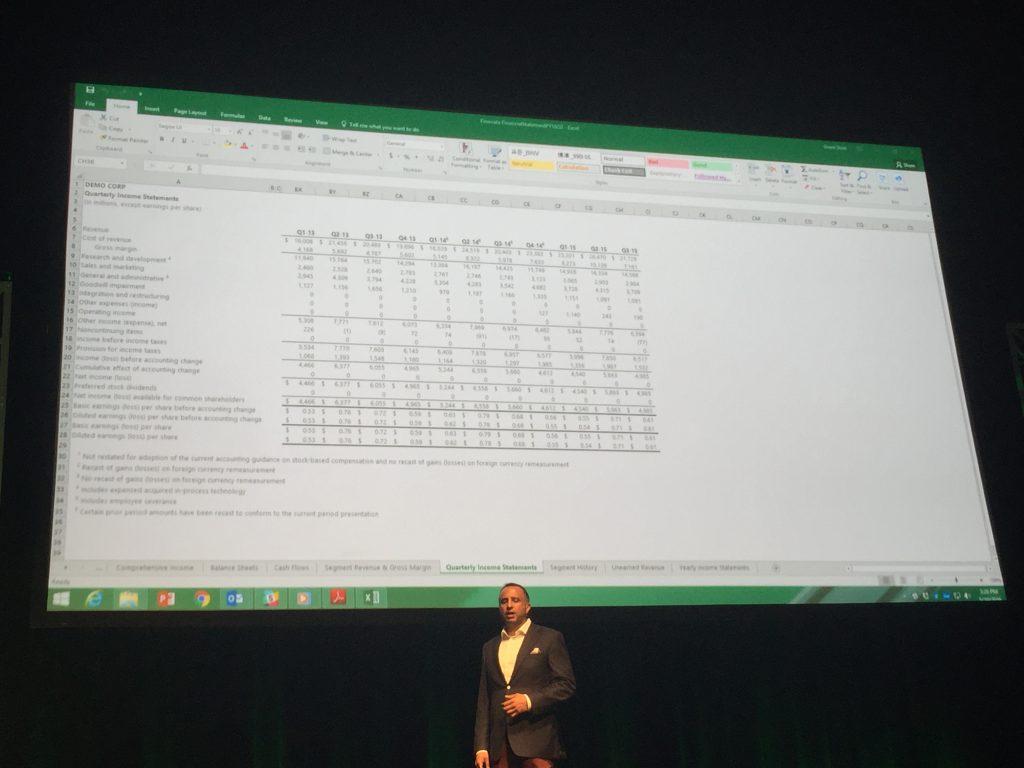

Earnix – @Earnix_Inc – http://earnix.com/

Aviv Cohen (VP, Marketing)

Marc Trudeau (Principal Consultant, Banking)

Earnix is providing advanced pricing tools for banks. This adds some solid tools to something that many banks are just using Excel for. The engine is using Apache Spark for decisioning. Better bank pricing based on advanced analytics. ^SR

From their website:

Earnix integrated customer analytics software empowers financial services companies to achieve optimal business performance through data science and predictive analytics. The Earnix analytical solutions drive superior product, pricing and marketing decisions, while ensuring alignment with changing market dynamics. Earnix combines predictive modeling and optimization with real-time connectivity to core operational systems, bringing the power of analytic-driven decisions to every customer interaction. ^KT

02:42 pm

OmnyPay – @OmnyPay – http://www.omnypay.net/

OmnyPay – @OmnyPay – http://www.omnypay.net/

Ashok Narasimhan (CEO & Co-Founder)

Amitaabh Malhotra (Chief Marketing Officer)

Mobile check-out at retail. Check out experience for customers is payments, loyalty, offers, rewards, and more. Private label basis – integrate into business mobile app. Interesting, incentivizes the customer to use the retailer’s preferred payment type by providing different discounts.

Demo – Authenticate with touch ID. Recognizes the customer and card on file. Customer verifies information. Once checkout in terminal – scans QR code see message on point of sale terminal. ^KT

02:34 pm

Moven – @getMoven – https://moven.com/

Brett King (CEO & Founder)

Rizwan Khalfan (Chief Digital Officer, TD Bank Group)

Moven brought customer on stage – TD Bank Group. Always a smart move at Finovate.

Moven demo – showing mobile account with spending wheel. Shows overages and charges that allow you to click through to change. Provides Bank’s customers with insights on real time basis. Shows spending path, and other features.

TD Bank Group did soft launch recently with great results.^KT

Moven is one of the top innovators in fintech. Today they are presenting with bank partner, TD Bank of Canada. The TD implementation has a great UI, with awesome ease of use. The app has been enhanced with predictive analytics. The focus is on mobile engagement and mobile acquisition, in real-time. 54k customers registered by TD in 5-week soft launch, over 150k accounts. ^SR

02:27 pm

Student Loan Genius – @MySLGenuis – http://studentloangenius.com/

Tony Aguilar (CEO & Co-Founder)

Emiliano Villarreal (Chuck Norris of Product & Co-Founder)

Student loans, I know that is a big problem for me. It is difficult to save for retirement while also paying off loans.

Student Loan Genius allows companies to help employees with student loans with payment plans, etc. Visitor comes to site and answers a few questions where her tool pulls in all student loan data. Then provides options on how your company can help her pay off her loans faster.

New product: Genius Saves. Companies can roll out student loan benefit to 401k.

^KT

Student loans are a massive issue for millennials, and for the economy as a whole. They have partnerships with Prudential and John Hancock. Today they are promoting Genius Save, a 401k product. Young professionals can’t afford to pay off loans, and put money aside for retirement. This product helps to address that gap. ^SR

02:20 pm

Payment.Ninja – @paymentninja – https://payment.ninja/

Daria Dubinina (CEO)

Andrey Morozov (Co-Founder)

Well, that was entertaining… A guy dressed as a ninja does tricks onstage.

Offering credit card payment for free for small merchants. No down-time, ever. Allowing banks or credit companies to use solution as a white label in the cloud.

Payment Ninja analyzes purchase and deploys an ad – demo is on facebook sidebar advertising. Consumer can check out through click on sidebar advertising.

But how are they going to make money? ^KT

Payment Ninja is offering a no-cost solution for card processing, on a global basis. This could be hugely disruptive in the payments industry. The tech infrastructure is cloud-based, and can be white labeled for use by FIs. I’m super curious about the business models here. No fees, no interchange, “no nothing.” ^SR

02:15 pm

OneVisage – @ONeVisageSa – http://onevisage.com/

Christophe Remillet (CEO)

They offer a product to address the issue of identity theft. A facial scanner works on a mobile device. Demo had some challenges, but may have been internet issues here in the hall. Going to give them benefit of the doubt on that. ^SR

3D Authentication Technology. Showing how a bank can use it using the photo function on a smart phone. Looks interesting.

I was watching Mission Impossible 5 on the plane out here yesterday where one of the identification methods in the movie was matching someone’s “walk, or gait” which is unique. I think in the future the WAY people hold their phones will identify themselves.

^William

02:06 pm

NYMBUS – @NymbusCore – http://www.nymbus.com/ –

NYMBUS – @NymbusCore – http://www.nymbus.com/ –

Mario Garcia (Chief Experience Officer)

First totally new core banking system (that I know of). I’ve heard various talk about NYMBUS. I believe some former Open Solutions folks work there (a WMA client for 13 years prior to their acquisition by Fiserv). I’ve heard they have been doing some demos in New England promoting the self-service aspect of their technology.

He is showing a browser-based screen “no green screens, user only sees what they need to see.” Now showing their CRM screen. Nice user interface. It looks pretty cool, I’m interested in hearing if any banks in the U.S. are using this as their core banking (or credit union) program.

“One platform, one data-set means easy reporting – one page, one access.” “We built this for a multitasking environment world.”

^William

Nymbus is helping to update the sleepy field of core banking applications. This space has been dominated by a small number of fairly staid players. So, lot’s of opportunity to apply new tech to create innovation. Nymbus is offering a modern software architecture and clean user interface. Data and dashboards can be customized for each role at the bank. The platform has CRM and business rules for decision management, built in. This is a tough space for a new player to break into. Banks don’t change their core system very easily, and it is hard to build the trust needed for a bank to rely on a new core processing system. ^SR

01:59 pm

Linqto – http://www.linqto.com/

Linqto – http://www.linqto.com/

Bill Sarris (CEO)

Kim Fraser (SVP, Bus. Dev., Wallaby)

Matt Kirchharr (Innovation Dev. Coord., LEVERAGE)

Linqto offers an App Store for banks and credit unions. The FI can brand an app, in this example Wallaby, very simply. Helps an app maker to partner with FIs. Helps the banks get easy access to a range of fintech apps. Very nice way to expand capabilities through partnering. ^SR

“US INVESTMENT IN FINTECH IS OVER BILLION” speaking of the change from traditional banking offering to an app-based world and how Linqto will help. LEVERAGE is their first channel partner. Allows any FI to offer their customers financial applications. Now showing Wallaby app, I’m assuming integrated with Linqto. He showed how the app was rebranded as a private app. “any FinTech app can be used by any FI with a touch of a button.” I’ve never seen anything quite like this. Interesting.

^William

01:20 pm

01:16 pm

Kore – @kore – https://kore.com/

Amit Aghara (SVP, Solutions Engineering)

David Schreffler (EVP, Sales)

They offer chat bots for customer support, with the ability to create custom bots. One use case is to use a bot, via text messaging, to help customers when they have potential credit card fraud. You can query the bot to find out your recent transactions. You just have a plain-language conversation with the bot. They use Natural Language Processing algorithms for the customer interaction. The bot can be accessed via chat, mobile, email, and other channels. ^SR

01:13 pm

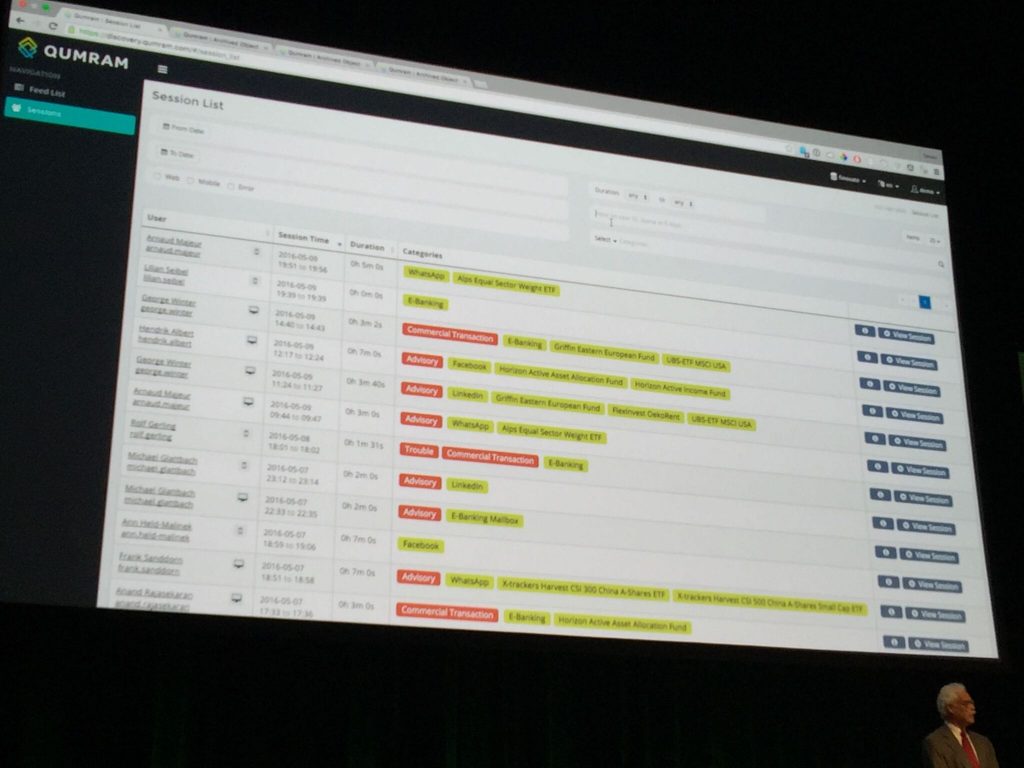

Qumram – @QumramAG – http://www.qumram.com/

Simon Scheurer (CTO)

Nicola Cowburn (CMO)

Patrick Barnert (CEO)

There is a growing focus on customer experience and related compliance issues. Qumrum allows banks to actually document customer interactions online. It combines screen recording (think screencast), with the ability to see the digital buying journey. From their website, “Qumram’s unique session recording, replay and web archival solution captures every keystroke, every mouse movement and every button click, via all digital channels.” ^SR

People want to work with the App of their choice – We have solved that problem. We enable FIs to record everything that goes on with the customers transactions on mobile, online, social and let the FI validate interactions on that site.

See dashboard of customers and everything that their are using. Such as LinkedIn, advisories, etc.

Recording like a movie player for conversation messages on LinkedIn. Are customers really using LinkedIn to reach out to their FIs? Records everything.

Providing full control of user interaction on all digital interactions. ^KT

01:02 pm

Kofax from Lexmark – @kofax – http://www.kofax.com/

Chris Edgington (Sr. Industry Solutions Marketing Mgr.)

Darren Collins (Global Dir., Banking & Insurance Team)

Paul Jacobs (Sr. Sales Engineer)

Showing a Know Your Customer solution on a browser-based platform. It looks like there are a LOT of browser-based solutions again this year. I keep thinking we are moving to an application world but here’s another browser-based platform.

^William

Kofax has a great suite of solutions for authenticating customers. Bank staff don’t need to key in information, reducing typos and incorrect info. For Banks, Know Your Customer, is a critical security responsibility. Kofax can do background search of other documents to help verify bank customer identities. Mobile capture of identity info, run through backend databases, and then a quick validation of the identity. ^SR

12:54 pm

Meetinvest – @meetinvestcom – https://meetinvest.com/

Michel Jacquemai (Chief Investment Officer & Co-Founder)

This is a tool that helps you to leverage stock research and stock picking tools. The idea is to popularize the kind of resources that only pro investors have had access to. “You’d have to read 200 research papers” to get this kind of insight. You can create portfolios, then execute the trades. This product can be offered as white-label, with the look and feel of your financial institution. This could be an easy way for a wealth advisor to get into this business, without needing the in-house IT teams. ^SR

Showing browser-based stock list; acts like a personalized financial consultant. Boy, Robo Advising is hot so I’m really looking for what makes Meetinvest different from other platforms. Want to partner with FI’s. ^WM

I’m sorry we are not putting more content up here. The WIFI is REALLY slow so we are working off the cell networks. I guess Finovate is getting more and more popular and everyone here has smart phones, tablets, computers and more connected to the Internet.

^William

12:46 pm

Empyr – http://www.empyr.com/

Jon Carder (CEO)

Empyr helps to connect online and offline businesses. Card-linked offers generated a lot of excitement a few years ago. They have a platform to source the merchant offers, and match them with card issuers. Empyr provides this functionality with no upfront cost to the banks or issuers. Not sure what the business model is here, or how they are different from other similar companies. ^SR

“Card-linked platform that generates new revenue for website sand apps while rewarding their users” Works with banks and credit unions for their customers.

^William

Interesting stat: Avg. 11 hours a day online. Connecting consumers online and driving them to offline stores. Link your card to website or app, select the offer. Then when you use the card at the store or restaurant you get the discount. Drive consumers to offline businesses. ^KT

12:38 pm

OurCrowd- @OurCrowd – https://www.ourcrowd.com/

Shai Ben-Tovim (Chief Product Officer)

Oshrat Kfir (VP, Engineering)

Silicon Valley is a hub of high tech investment. OurCrowd is bringing a fintech solution to the process of sourcing and managing deals. Why shouldn’t all those VCs have a mobile app? The company is demonstrating a mobile-based “deal room.” You can invite experts to be part of a deal team, conduct mobile chats, and vote thumbs-up/thumbs-down in quick polls. Certainly an interesting application, but I’m not sure what differentiates from any other team collaboration tool. Do I need one just for an investing team? The platform does apparently have other resources for startup investing, will have to check website for that. ^SR

Our crowd is showing a mobile-based crowd funding platform for corporate funding; sort of like you don’t need VC. My question is what makes it unique from other platforms?

^William

12:34 pm

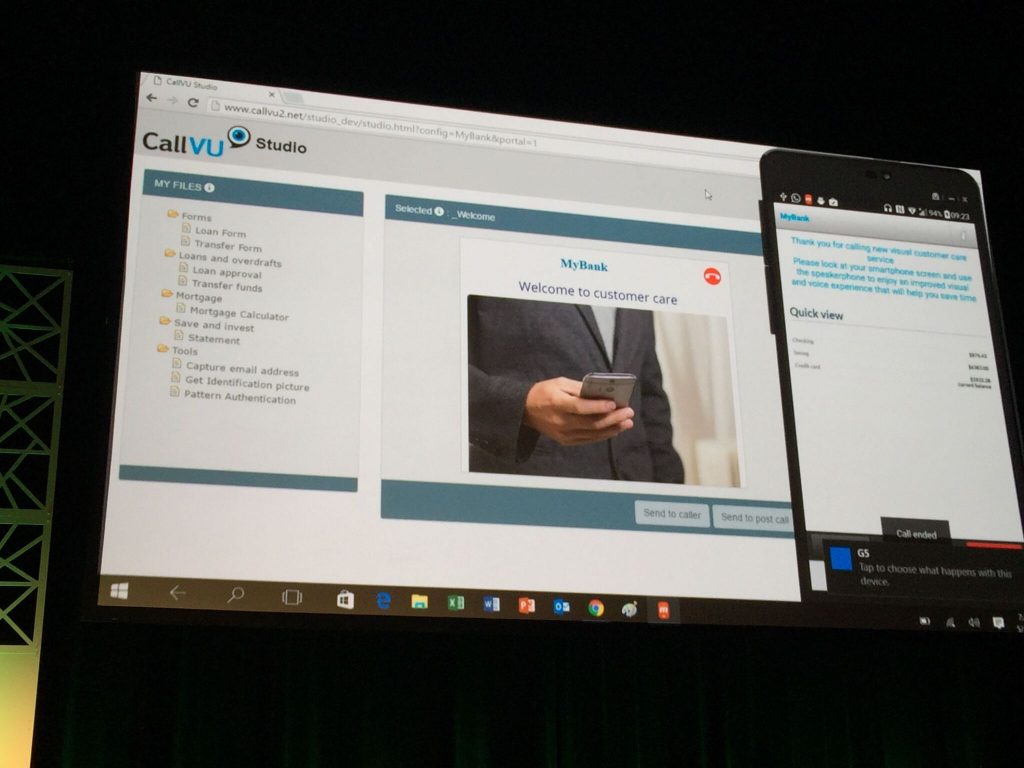

CallVU- http://www.callvu.com/

CallVU- http://www.callvu.com/

Assaf Frenkel (VP, Product & Marketing)

Amitai Ratzon (VP, Global Sales)

The Studio allows you to customize the information the banker has at their disposal, in sync with what the customer is experiencing. The banker can see where in the journey the customer is. The agent’s interface parallels the mobile app that the customer sees. CallVU helps the banker to better relate to the customer journey, with information relevant to each stage. ^SR

Showing: Digital engagement solution. Customer care turning into a customer journey.

Demo: calling customer service and screen shows personalized information such as info about checking account instead of the standard number screen on the phone. Authentication options such as pin, fingerprint, etc.

Doing a transfer from the phone account and get confirmation. – It looks like mobile banking. Leveraging assets from mobile banking and moving into the customer journey. i.e. showing the mobile banking when they are calling customer service.

Demo 2: when a customer does need to talk with an agent.

Interesting take on managing customer experience, a big topic nowadays. It’s not about customer service but rather customer experience. ^KT

12:33 pm

Finova Financial – @FinovaFinancial – http://www.finovafinancial.com/

Gregory Keough (CEO)

50% of Americans can’t come up with 0 in the case of an emergency. Some people turn to title loans on their car. Finova is offering a consumer loan product that allows people to unlock the value in their car, without paying exorbitant rates. Borrowers also have the ability to pay over 12 months, not 30-60 days. Information on the auto used for collateral is assessed by an automated platform. This is car-title lending updated by fintech. ^SR

Finova Financial – @FinovaFinancial – http://www.finovafinancial.com/

Gregory Keough (CEO)

Greg is trying to “reinvent” getting money to people. “The Finova Financial” Car Title Credit Solution – costs 70% percent less than industry average.” Like a HELOC on your car but using a technology platform. Connecting to DMV’s across the country. “Quick and easy” Photo of DL, income, title, etc.

While I’m not a big fan of car title loans I suspect these folks are using tech in a positive way and help cut costs to borrowers. Good job.

^WM

12:32 pm

Payment Data Systems – http://paymentdata.com/

Houston Frost (SVP, Prepaid Products)

Matt Decker (VP, Technology)

Payment Data Systems is unveiling Akimbo Now, delivery of digital cards that eliminates the need for plastic. Well, definitely an environmentally-friendly solution. The demo shows delivering a gift card via mobile phone. Both businesses and consumers can use the online portal, and there is also an API . Why send a digital or virtual card? Wallets are thick enough already, there’s no need for plastic. There is a “full stack”, or turnkey, solution depending on what the FI needs. ^SR

“Akimbo Now” contactless demo: instant digital contactless cards. Can be used for banks and credit unions as well. Now showing the process to order gift card to their phone. “ApplePay and Android Pay adoption is much faster than the plastic card 50 years ago.” ^WM

11:42 am

Welcome to Finovate! William Mills, Steven Ramirez and K.T. Mills-Grimes will be live blogging at FinovateSpring 2016. Check back for updates throughout the day. ^KT

Some of the top companies in fintech are gathered for the Spring Finovate conference in San Jose. We’ll be blogging live from the 2-day event, covering over 72 companies. We expect to see innovations in mobile, security, analytics, customer experience, and more. ^SR

Well, it’s almost show time here in San Jose! Greetings from Finovate Spring. We are looking forward to another great show. We are on the front row if you would like to stop by to visit KT or myself, we should be available at breaks or email me at william@williammills.com. ^WM

As usual, the hall is filling up fast and attendance is expected to top 1,500. There’s wall-to-wall startups looking to disrupt, or maybe partner with, the top banks and wealth management firms. Investors have turned up, from VCs and Private Equity, to the investment bankers and strategic venture partners. And of course, bankers representing some of the largest global institutions, as well as plenty of small players, too. ^SR

William Mills III, Chief Executive Officer of William Mills Agency is live blogging today at FinovateFall 2015. He has more than 30 years of experience in financial technology and is a recognized leader in financial and technology marketing. He has personally advised more than 300 chief executives on marketing strategy, business development, mergers and acquisitions, company branding and public relations. You can contact him via email at william@williammills.com or on Twitter @williamemills.

William Mills III, Chief Executive Officer of William Mills Agency is live blogging today at FinovateFall 2015. He has more than 30 years of experience in financial technology and is a recognized leader in financial and technology marketing. He has personally advised more than 300 chief executives on marketing strategy, business development, mergers and acquisitions, company branding and public relations. You can contact him via email at william@williammills.com or on Twitter @williamemills.

Steven J. Ramirez is CEO of Beyond the Arc, Inc. Harnessing data science and deep marketing expertise, he and his team deliver analytics-driven Customer Experience solutions. Their work includes strategic initiatives at a Top 5 US bank where they directly improved Customer Experience through communications. Helping financial service clients create rapid wins through intensive data strategy and improved customer engagement is their specialty. For more information about Beyond the Arc visit beyondthearc.com, call 1-877-676-3743, or email web@beyondthearc.net. Insights on social media, financial services and more are shared on their blog, or follow them on Twitter at @beyondthearc. ^SR

Steven J. Ramirez is CEO of Beyond the Arc, Inc. Harnessing data science and deep marketing expertise, he and his team deliver analytics-driven Customer Experience solutions. Their work includes strategic initiatives at a Top 5 US bank where they directly improved Customer Experience through communications. Helping financial service clients create rapid wins through intensive data strategy and improved customer engagement is their specialty. For more information about Beyond the Arc visit beyondthearc.com, call 1-877-676-3743, or email web@beyondthearc.net. Insights on social media, financial services and more are shared on their blog, or follow them on Twitter at @beyondthearc. ^SR

K.T. Mills-Grimes is the Digital Marketing Consultant at William Mills Agency. She manages all digital and social media efforts on behalf of agency clients. K.T. also conducts the planning and day–to–day management of all related marketing activities.

K.T. Mills-Grimes is the Digital Marketing Consultant at William Mills Agency. She manages all digital and social media efforts on behalf of agency clients. K.T. also conducts the planning and day–to–day management of all related marketing activities.

As a HubSpot certified specialist, K.T. oversees all online communications including SEO, website developments and content marketing campaigns. You can reach her via email at kt@williammills.com or on Twitter @wmakt.

Download: 10 Reasons Why Fintech Startups Fail White Paper