Good day! Welcome to FinovateSpring 2018. I’m here at the Santa Clara Convention Center covering the demos.

In addition to two great days of demos I’m looking forward to days 3 and 4 of conference content and a panel session I’m hosting on Friday. This is either my 21st or 22nd Finovate; I’m not sure. I’ve participated in every US event except one as well as Finovate Europe last year. There are a number of great events in FinTech but this one I do my best to attend each year. If you are here at the conference feel free to stop by at the breaks, I’m on the front row or email me at william@williammills.com.

10:17 am

#finovate Tweets07:00 pm

Well folks, Day One Demos are complete and it’s time to network. I hope you will be back for tomorrow’s live blog starting 9:30am PST.

Again, if you are here at the conference please visit my session on marketing to millienials with top executives from Wells Fargo, Ondot Systems and other companies. Feel free to reach out to me via email at william@williammills.com or mobile +1 678-694-7213. I’ll be at Finovate through Friday.

See you tomorrow!

William

And almost unbelievably, we are at the end of Day 1 at Finovate! Visit us again tomorrow for our live blog, with re-caps of another 20+ companies. ^Steven

06:57 pm

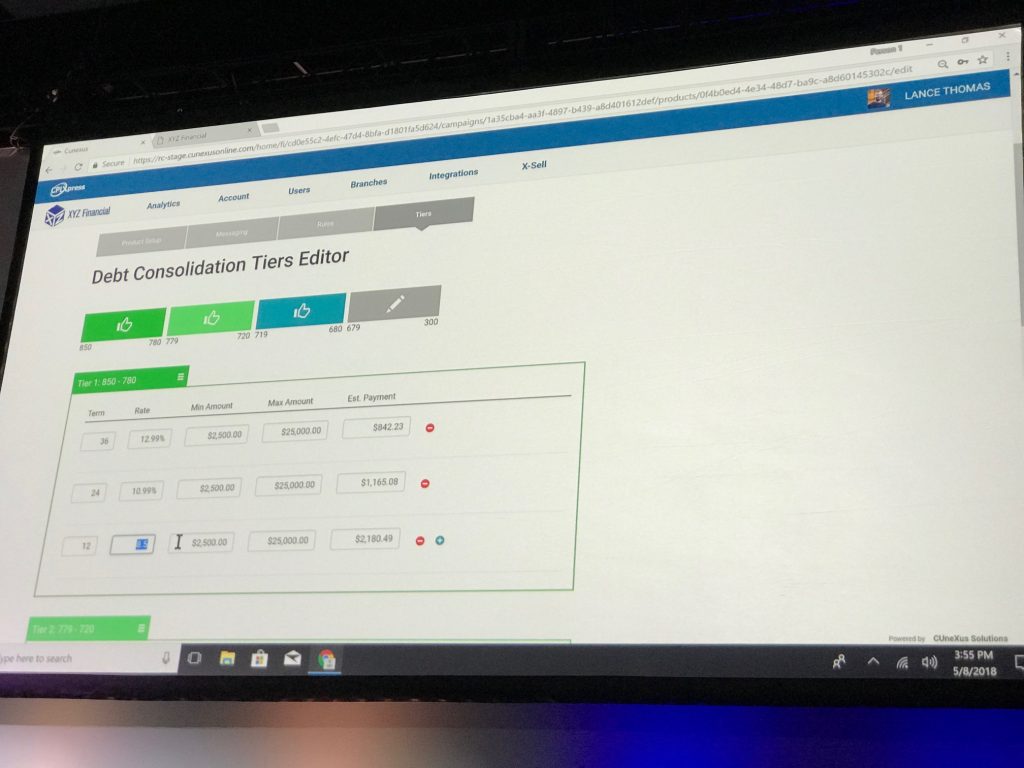

CUneXus , https://cunexusonline.com/ @CUneXus

CUneXus , https://cunexusonline.com/ @CUneXus

Presenters:

- Dave Buerger

- John Reich

Info: CUneXus’ lending and marketing automation platform uses advanced data-analysis, user-friendly workflows and existing digital banking delivery channels to eliminate unnecessary friction from the consumer lending process for banks, credit unions and their customers.

I met with David prior to the demo and got a pre Demo Demo and I was REALLY impressed. Unbelievably fast lending product offers for FI’s based on their customers. Literally he was able to lock a loan in less than 10 seconds.

“Perpetual Loan Approval” Imagine logging in your mobile bank app at any time and find EVERY loan you can instantly lock in. Auto, HELOC and more. 78 FI’s are already using this. 7 million consumers have access to this app today – I think through mobile banking solutions. “CPL” Comprehensive Pre-Screened Lending. Today are giving a sneak peek of their product line. It integrates with your current IT stack.

Guys, fantastic job. Keep up the great work. ^William

From their web site:

Application-free consumer lending

The cplXpress platform enables financial institutions to take their services mobile, and deliver the personalized, mobile, always-on retail services consumers have come to expect. Lending institutions can automatically issue approved loans for multiple loan products based on their own credit and risk criteria and customer information. Once approved, loan offers are delivered through a suite of online banking, marketing automation, and cross-selling applications, where and when the customer needs them.

“Perpetual loan approval” with a personalized borrowing experience.

Check out our previous commentary on this company. They have been here at Finovate since back in 2014. ^SR

06:47 pm

280 CapMarkets , 280capmarkets.com @280capmarkets

280 CapMarkets , 280capmarkets.com @280capmarkets

Presenters:

- Gurinder Ahluwalia

- Dave Rudd

- Prescott Nasser

Info: 280 CapMarket’s fixed income technology uses a combination of uniquely curated market information and proprietary platform capabilities to improve market openness and price transparency for independent financial advisors.

Can search for bonds by interactive maps. Again, I like their web-based UI. This may be the first demo today with an interactive map for the financial professional. BonNav helps advisors find the right bond, from the right issuer for the right buyer. I don’t think I’ve seen then at Finovate before. They did a very good demo. ^William

Tools for independent financial advisors, so they can trade bonds more efficiently. Advisors can set their criteria to find the bonds that are a good fit for a client. 280 also owns a portfolio of bonds, that they make available on the platform. “Imagine capital markets in the cloud. ^SR

06:40 pm

BlueRush, http://bluerush.com/en/ @BlueRushdm

BlueRush, http://bluerush.com/en/ @BlueRushdm

Presenters:

- Ted Mercer

Info: BlueRush’s DigitalReach software creates and distributes interactive and personalized digital experiences to improve engagement and conversion rates for advisors (wealth, insurance, and mortgage).

SaaS Solutions for Financial Services based in Toronto and has raised more than million in funding to date. Showing web-based platform (about 2/3 of demos are using the web and showing their product on the Chrome browser). Nice content library for FI’s. ^William

Customers often start an online transaction, but then drop out of the process. This “funnel abandonment” is one of the toughest problems to solve in ecommerce. Blue Rush has a platform to leverage content and customer info to move people through the buying funnel. In the context of a mortgage refi, that content includes video, articles, and financial calculators. There is personalized video, based on the client’s profile.^SR

06:33 pm

Paysend, https://paysend.com/

Paysend, https://paysend.com/

Presenters:

- Ronnie Millar

- Alex Murashko

Info: Next generation global money transfer platform launching a Global Account integrating fiat and crypto money with a physical hard. Money without borders.

Scotland-based company that I THINK I saw present in the past. “Money without borders.” Showing mobile app version of their product. It sounds like a much needed mobile app/payment platform. VERY clean and simple UI. They transfer money between a ton of countries. Good job on the demo. ^William

A single app to send “money without borders.” Multi-currency capabilites and the demo shows GBP, USD, and BTC. You also see any fees on the transaction. With a virtual card, they can match a card to the currency of choice. Seems like a good way to avoid exchange fees. They are a fully licensed FI in Europe. ^SR

From their web site:

PaySend: A New Generation Of Money TransfersWe are on a mission to change how money is transferred around the world. We have designed a solution that sends money faster, safer, easier and instantly for only £1, 1.50€, .

How do we do it?

No more cash, no more complicated forms to complete, no more bank account numbers, no more IBANS, no more sort codes, no more queuing and long trips to pick up the transfer. Just the 16-digit VISA or MasterCard number. Once you try us, you will never go back transferring money the old way.

We call it ‘Card to Card’, it’s the secret to £1, 1.50€, instant transfers.

06:28 pm

Mawi Solutions, mawi.band @mawiband

Mawi Solutions, mawi.band @mawiband

Presenters:

- Ron Fridman

- Egor Avetisov

- Maria Gurina

Info: Mawi Solutions’ wristband uses an ECG-based method of authentication to make payments via wearables more secure.

Ukranian-based company showing new method of authentication method. Great use of humor. www.mawipay.com So, it uses your Fitbit type device to make sure you are really you when you are doing a transaction. Pretty cool. ^William

Ultra-secure

ECG Biometric

Authentication

Secure payments and identification

with your heartbeat

There is no doubt that wearable payment is an emerging tech trend. This solution uses a heart rate monitor to authenticate the wearer of a payment device. Demo featured some excellent live jump rope! A finovate first? The pilot in Eastern Europe was with 70,000 people. Uses your heart as a means of biometrics. ^ SR

06:24 pm

Baker Hill, bakerhill.com @bakerhill

Baker Hill, bakerhill.com @bakerhill

Presenters:

- Mike Horrocks

- Eric LaPlante

Info: Baker Hill’s small business loan application and auto decisioning solution uses a responsive turnkey, web-based application that facilitates information sharing and automated credit decisioning to generate profitable growth in the small business loan portfolio while reducing risk and meeting customer demands for speed and convenience. (Full disclosure: William Mills Agency represents BakerHill for public relations.)

“Get funding fast for your small business”

“For 35 years we have been helping FI’s build better, more profitable relationships with their customers.” “We align with your credit risk guidelines for higher completion rates and meet Reg D guidelines through our platform.”

They are showing the web-based platform – the hub of BakerHill next gen with interactive reporting that can be shared across the enterprise. Nice UI. End to end decisioning built in. Mike is doing a great job demonstrating the Baker Hill advantage over types of loan systems; whether it is legacy companies or other new entrants to the commercial lending space. Partnered with Compliance Systems, Inc. and is now showing a very cool portfolio management graphical dashboard. Take your small business lending to the next level as they have for more than 500 banks including 20% of the larges banks in the country. ^William

Online loan origination for small business lending. The product provides support to FIs with standard workflows, managing everything from acquisition to servicing. The underwriting is based on your bank’s underwriting policies. You can also go with a manual decision, to fully automated process. The flexibility of Baker Hill is a real strength of this lending platform. This is offered as a SaaS subscription. ^SR

About Baker Hill at Finovate Spring

At FinovateSpring, Baker Hill will demo its small business online loan application and auto decisioning solutions, which are powered by Baker Hill NextGen®, the cloud’s most powerful, cutting-edge common loan origination, risk management and analytics solution. Baker Hill NextGen® is designed specifically to meet the current and future needs of progressive financial institutions in a single platform. Baker Hill’s small business online loan application and auto decisioning solutions are the latest tools supported by the platform that financial institutions can leverage to meet the needs of their business customers while improving lending efficiencies and small business loan profitability.

06:11 pm

SaleMove, salemove.com @SaleMove

SaleMove, salemove.com @SaleMove

Presenters:

- Dan Michaeli

Info: SaleMove’s omnichannel customer engagement platform targets the disjointed online customer experience for large entreprises (typical financial services) providing complex products online.

I’ve seen these folks before and was impressed to I’m looking forward to hearing about today’s demo. They facilitate co-browser between call centers with customers as “most of the time your customer is already online with your bank when they call you.” This really makes sense to me. It takes about two to three weeks to deploy in an FI. Getting ready to show a digital interaction i.e. video/audio/chat/phone.

I used Amazon Chat recently to get a refund and it SURE was faster than calling one of the CSR’s so I could see how FI’s would benefit from their approach. I’m not sure how much of this business is related to the financial industry so I’m going to do more research on the company.^William

We’ve written about SaleMove in the past. This time, they are showing a demo of their customer engagement solution with co-browsing. You can add a video window directly embedded into your site. The tech integration takes a matter of weeks, they say. The product now includes a chatbot AI, providing recommendations to employees in their interactions with customers.^SR

06:01 pm

WE ARE GETTING READY TO START AGAIN STANDBY

05:17 pm

Break time. See you in 10 minutes or so.

William

05:13 pm

Omega Point , ompnt.com @omegapointhq

Omega Point , ompnt.com @omegapointhq

Presenters:

- Omer Cedar

- Eran Cedar

Info: Omega Point’s portfolio performance enhancement platform uses a unique, easy-to-use visual interface to provide quantitative knowledge and resources for traditional portfolio managers.

“Market aware AI” Info delivers to portfolio manager. I’m having a hard time grasping their value proposition so I’ll have to learn more.

These folks look like they are based in the SF Bay area and have raised .5 million in funding.

05:03 pm

QCheque, qcheque.com @QCheque371

QCheque, qcheque.com @QCheque371

Presenters:

- Shoaib Shafquat

- Tom Coke

Info: One of the greatest vulnerabilities of the traditional paper check is that the account number is clearly visible. QCheque masks the account number with an encrypted QR code, and then facilitates every aspect of the paper check processing rail in accordance with applicable laws, rules and regulations.

“We replace the check account number with a QR code.” I like their concept but couldn’t someone read the QR code easily, like people can read airline ticket QR codes? These folks are from Detroit and I’m glad to see FinTech from Michigan again. There used to be so many FinTech companies in Michigan that my barber was in Detroit (and I live in Atlanta).

OK, it’s an encrypted QR code with a unique ID for each check. I like it. I have not seen any other technology like this. Good job. ^WM

They want to disrupt banking and fintech, with a new take on the paper check. Whoa, tall order, I think! They take the account number off the check, and replace it with a QR code. This addresses a problem with check fraud. They want to be the world’s most secure paper check. Interesting idea, and definitely seems to be an improvement. Jury may still be out if we need improved checks at all… ^SR

04:57 pm

Q2 Software , q2ebanking.com, @q2ebanking

Presenters:

- Rahm McDaniel

Info: Q2 Software Biller Direct offers card payments for bill pay, wrapped in a modern user experience to target costly economic model of bill pay.

Q2 is talking about bill pay today which is unusual because they are thought of a mobile banking provider. Founded by Hank Seale, who previously founded Q-Up (sold to S1, now ACI). Today launching Q2 Biller Direct. I’m wondering if they bought another tech company or built this in-house.

While I’m sure it works and everything but he’s not showing a demo yet, it looks like a Powerpoint or Prezi and not a real demo. Hopefully I’m wrong as it’s against Finovate rules to use presentations and not real demos. If they are showing a REAL system I apologize. ^WM

Do you have to visit 4-5 websites to pay your bills? Bill pay is good, but it lacks immediacy. The Biller Direct product combines bill pay, with the convenience and real-time nature of a credit card. And people get up to date info on their payments. I know that as a consumer, this is a very real pain point for me. Did they get my payment? Was it credited properly? ^SR

04:50 pm

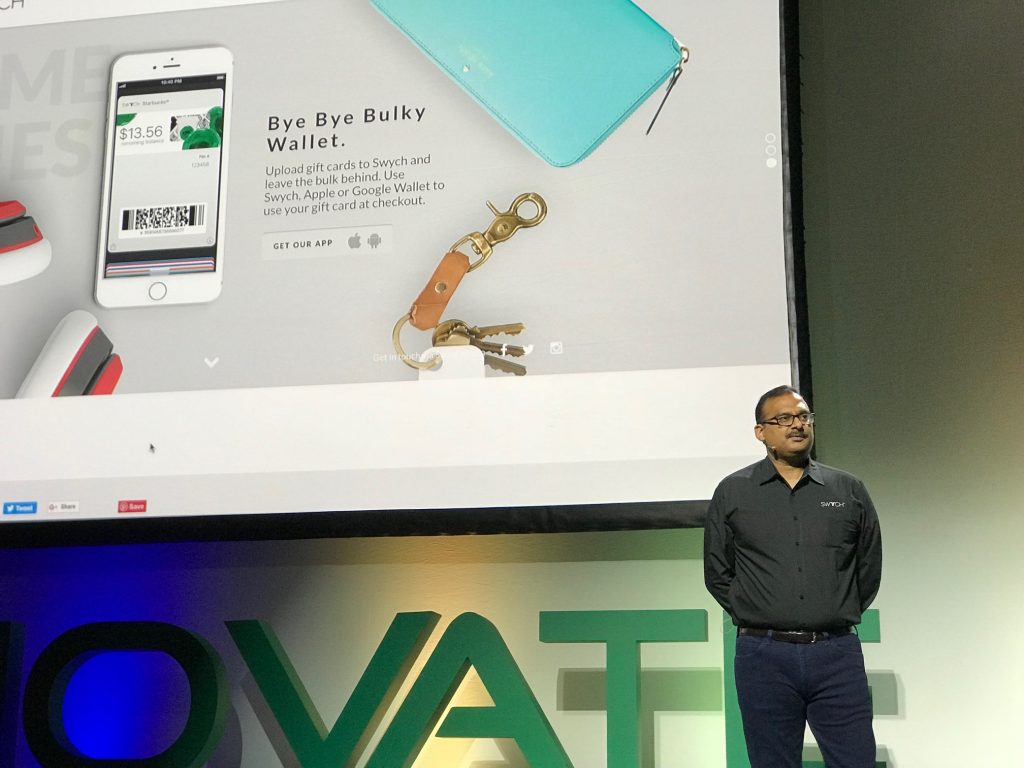

Swych, http://goswych.com/ @GoSwych

Presenters:

- Deepak Jain

- Harpreet Chawla

Swych’s global blockchain framework creates an alternative way for cryptocurrencies to be used through its global shopping and gifting network featuring thousands of retailers.

I saw these folks a year or two ago and remember being really impressed. SWYCH that let’s folks send gift cards via mobile AND can change the merchant. For example, switching a Macy’s Gift Card to a movie chain (AMC) and sometimes get MORE credit from a different retailer. I thought this company was cool in the past and continue to believe it today. Launching today cross-border payment gifting. I really like it. Great job. ^WM

04:44 pm

Kyndi, https://kyndi.com/ @kynditech

Presenters:

- Ryan Welsh

- Lorne Kligerman

- Kyndi’s Explainable AI uses a unique ensemble of AI technologies and quantum emulation that reads and comprehends unstructured data (text) for risk mitigation and compliance for financial services executives.

“We build explainable AI capabilities for FI’s as FI’s can’t always use “black box” solutions.” They have raised at least .5 million in funding through their Series B round and are based in San Mateo, CA.

Speaking about the networking of financial documents. ^WM

Explainable AI for financial services. They use a mix of machine learning, natural language processing, and related technology to extract information, identify trends, and act on it. The system has a critical attribute, which is the ability to build automated workflows. Your data is brought into a cognitive platform, and visualized in new and interesting ways. This can make artificial intelligence for many organizations. ^SR

04:37 pm

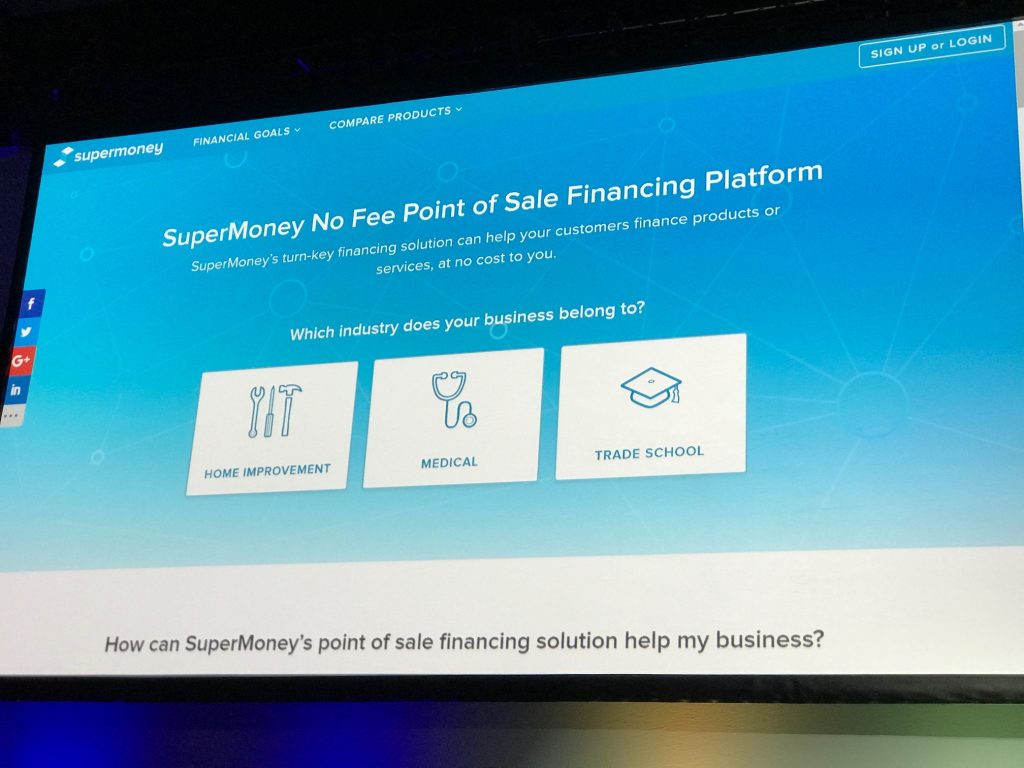

Supermoney, supermoney.com @supermoney

Presenters:

- Miron Lulic

- Jesse Stockwell

- Max Yen

- SuperMoney’s Dealer Financing Platform offers affordable and efficient point of sale financing options for customers of small and medium businesses.

POS financing. “If you are bank or CU, pay attention. Millions of people come to us to find their financial provider. Generated 1/2 billion in financing so far.”

Launching today SuperMoney POS solution. Showing how it works for a small merchant in Santa Clara. Integrated with direct and indirect lenders. These folks are out of Southern California and looks like they have raised about in funding.

“SuperMoney No Fee Pint of Sale Financing Platform” is the new product launch today. These folks are really passionate and good speakers and are pretty bold. “We will be the Amazon of Financial Services.” ^WM

Point of Sale financing makes it easy for consumers to buy what they want, when they want it. But, if they don’t have money in their pocket, new sources of loan funding become important. Supermoney aggregates offers from online lenders, to find the best deal. There’s no fee to the consumer. This offering lets small businesses access the kind of financing available to large merchants. For the lender, they can underwrite more loans with this source of new opportunities. ^SR

04:30 pm

Windward Studios windward.net/windwardstudios @windwardstudios

Presenters:

- Donny Zwisler

- En-Jay Hsu

- Windward Studios’ embedded software solution uses a standard web browser with familiar design features, functionality and free-form design control to generate high-volume data-powered reports for software companies and enterprises.

This is a different kind of Finovate company. These folks seem like they have a pretty cool horizontal business solution related to document functionality. I would imagine a ton of this business is from FI’s. They are really Microsoft focused for generating MS Word, Excel and PowerPoint files. Today they are announcing their online word processor/report generator. I’m not sure of the costs yet. ^WM

From their web site:

For over 10 years Windward has been making software that allows business users and developers to create data-powered documents of all types including: forms, proposals, statements, reports, presentations and more. Windward’s novel approach to connecting sophisticated data sources to highly-formatted documents began by providing add-ins for Microsoft® Office applications that allow users to “tag” elements within a document to be dynamically replaced with data from a variety of possible data sources. Windward’s solutions have become the leading choice for developers adding reporting and document generation capabilities to their applications in over 70 countries around the world.

04:26 pm

Folks we are back…stand by.

03:13 pm

Well folks, it’s time for a lunch break. I hope you will join us back in less than an hour.

I want to thank KT Mills-Grimes and Lauren de Gourville at William Mills Agency for all their hard work on this endeavor. Thank KT and Lauren, we all really appreciate it.

William

03:10 pm

Spave

Spave

www.livegivesave.com @livegivesave

www.livegivesave.com @livegivesave

Presenters:

- Susan Langer

- Ajay Nair

- Live.Give.Save encourages balanced spending, saving and giving habits, particularly for millennials.

Showing mobile app for their controlled beta. Will be app store in late June. Fee-based revenue model.

Good for consumers, banks, communities, non profits and more. Again, this market segment is hot.

This segment used to be PFM now it’s about helping the millions of Americans improve their fiscal lives.

These folks are mobile first – God Bless You.

So many folks don’t “get” if the end user can’t use the app or platform on an iPhone or Android phone then folks won’t use it. They have a very nice UI. It seems pretty well developed for being at such an early stage. I think this is an up and coming company. They are seeking Series A funding and partners. Good job. ^WM

Should I be saving more for my future? Or donating more to the charity that I love? Well many Americans don’t have enough money for their retirement, and feel they can’t contribute as they’d like. So this is a solution for saving and giving. You can search for the charity you want to support, and 1.5 million are in their system. ^SR

03:02 pm

Moneyamigo , http://moneyamigo.com/ @MyMoneyAmigo

Moneyamigo , http://moneyamigo.com/ @MyMoneyAmigo

- Presenters:

- Kim Norland

- moneyamigo’s platform challenges the lack of simple & clustered “money & life” services and provides a fast and friendly solution that truly makes a difference.

The whole market segment of helping low income folks or people with low credit score is a big topic this year. Showing mobile app with nice mobile video intro. It looks like KYC through scanning drivers license and SSN and security question. Kim just opened an FDIC insured account in about 30 seconds. Consumers receive debit card in the mail. This is also a great mobile UI that is super slick. What I’m interested in how they will make money. Will they compete or sell to FI’s? I don’t know. I think I saw them in 2015 at Finovate.

Showing merchant discounts related to medical/dental. Now showing an Alexa-like voice AI with balance amount and money transfer. Very good presentation.

02:55 pm

Interested in other FinTech Trade Shows for 2018? Download or 2018 Trade Show Directory!

02:54 pm

Eltropy , eltropy.com @eltropy_inc

- Presenters:

- Ashish Garg

- Troy Pittock

- Eltropy offers text messaging as a customer engagement channel using AI-driven business intelligence, governance and compliance.

“How many people text family and friends?” About everyone.

“How many people text their financial institution?” Almost no one.

We connect FI’s to their customers. This is sounding very cool.

SALES, MARKETING, SERVICE use cases. “Texting changes the game.” Man, I like these folks. My call center experiences with my FI’s are NOT good and I get so many spyware emails I’m hesitant to trust any bank emails. These folks are really on to something. They are based here in the SF Bay area. They have seven customers and I’ve found no major investors so I suspect they are seed funded as well as their clients. Great job.

From the web:

Eltropy, SaaS platform improves share of wallet, client acquisition and productivity of client-facing teams in banking and financial service ^WM

This company enables banks and credit unions to use texting to develop deeper relationships with customers. They have a sales use case that helps you follow-up with customers after they walk out of the branch. ^SR

02:47 pm

Ephesoft , ephesoft.com @Ephesoft

Ephesoft , ephesoft.com @Ephesoft

Presenters:

- Scott Lee

- Chris MacWilliams

- Ephesoft’s Mortgage Intelligence solution uses machine learning to automate and detect fraud during the lending process.

I’m sure I’ve seen these folks before and if I’m not mistaken I was pretty impressed last time. Now showing their web-based platform project screen with use cases like KYC, mortgage processing, Invoice Processing. Now showing a mortgage loan origination and processing case use. Showing the Schedule C, 1040 etc. PDF turning unstructured data i.e. from the PDF’s. Now showing dashboard comparisons.

There is a TON of unstructured data in financial institutions. I imagine if most banks are looking at this company or their competitors now, they will be in the next few years. ^WM

02:39 pm

Buckit, buckitapp.co @buckit_app

Buckit, buckitapp.co @buckit_app

Presenters:

- Umar Syyid

- Joe Chen

Info: Buckit’s mobile app gives credit card borrowers the tools for active, cohesive and intelligent debt management.

“70 million Americans with bad credit. Our mission is to help consumers with their credit health and it’s also good for lenders. Credit health is hard.”

Showing nice mobile app, IOS, with a great mobile UI. It is hard to know what people need to do to improve their credit health. This emphasis on credit health is so important and a win-win for consumers as well as financial institutions.

These folks are very early stage but look very strong. They are based in Boston and have only seed funding of less than 0,000 according to Crunchbase.

Their solution seems “fully baked” and working well. Great job. ^WM

02:32 pm

NTT DATA , https://us.nttdata.com/en/

Presenters:

- Takashi Murakami

- Sato Kazumasa

- Rika Igarashi

Info: NTT DATA has created a social community to share investment experience, knowledge and lessons.

NTT DATA SMS-based platform for investment via banks and other FI’s. I belive this is their first Finovate as I’m not familiar with this product. Showing mobile app on how people can copy investment portfolios information via social connections.

I believe this is part of a huge Japanese-based conglomerate. From their Crunchbase profile:

NTT Data

NTT DATA provides broad range of IT services and solutions, including consulting, systems integration, and IT outsourcing.

Categories Information Services , Information Technology , Software

Founded Date 1967

Founders Harsha Rajasimha

Number of Employees 10001+

NTT DATA provides broad range of IT services and solutions, including consulting, systems integration and IT outsourcing, for major financial, public administration and enterprise sectors. NTT DATA Group has established global support network that covers 65 cities in 21 countries worldwide (as of October 2008). ^WM

Fintech is truly global, so it is great to see some global players. This is an SMS solution for social networking and investment. Interesting idea to make use of text messaging, in addition to the investment functionality in their app. The functionality allows for sharing of portfolios.

The idea of relying on a community for investment advice has pros and cons. You can learn from the community, but I am concerned about what prevents genuinely bad ideas from being widely shared… Also wondering about the potential for bad actors and things like stock manipulation and pump and dump schemes. ^SR

02:25 pm

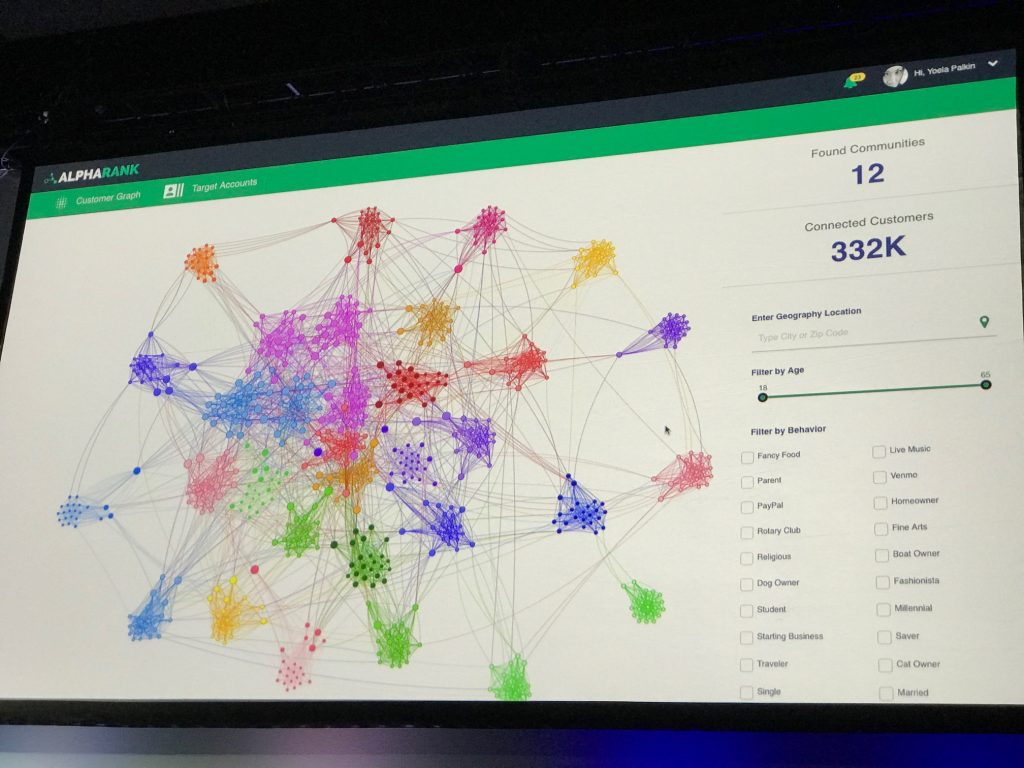

Alpharank, http://www.alpharank.io/ @Alpharank

Alpharank, http://www.alpharank.io/ @Alpharank

Presenters:

- Brian Ley

- Yoela Palkin

Info: Alpharank uses debit and credit card transaction data to map offline social networks that financial institutions can use to amplify marketing and detect synthetic fraud.

“If you are a bank or CU with three years of customer data you are sitting on the most valuable information possible. You can build your own customer graph. Processed a billion in transactions.” Wells Fargo is an investor. Showing FirstData Connected 1.2 billion transactions found. This sounds VERY cool. For about four years we worked hard to make CARDLYTICS famous but this seems much stronger. Instead of offers an FI can find the behavior attributes that define the FI’s communities.

I REALLY like what they are showing – quickly and easily identify and visualize your customer base. Great job.

Is your bank mining your own social customer graph? Alpharank was founded a year ago and received an initial investment from Wells Fargo. What can you do with your historical transaction data? They work with anonymous transaction and card processing data. They are working with anonymized data. Alpharank helps you with a variant of “look alike” modeling, by identifying consumer behavioral patterns. ^SR

01:35 pm

Time for a short break. This has been a great group of companies. I’m here with my friend and cohort in FinTech Mr. Steven Ramirez up front and his comments are included in our live blog under the reference ^SR. He’s a genius and I don’t mind telling him this as it’s true.

Time for a short break. This has been a great group of companies. I’m here with my friend and cohort in FinTech Mr. Steven Ramirez up front and his comments are included in our live blog under the reference ^SR. He’s a genius and I don’t mind telling him this as it’s true.

His biggest takeaway from the first demos: “We are off to a great start. The solutions are driven by data and companies are finding ways to take action on it.”

We’ll be back online in about 15 minutes.

William

01:30 pm

Ondot Systems, http://www.ondotsystems.com/ @ondotsys

Ondot Systems, http://www.ondotsystems.com/ @ondotsys

Presenters:

- Vaduvur Bharghavan

Info: Ondot uses crowd sourced payments data with real time analytics and machine learning algorithms to improve automation, trust, control and management of invisible payments. (Full disclosure: William Mills Agency represents Ondot Systems for public relations.)

Vaduvur Bharghavan aka “VB” is on the stage. They won a “Best in Show” at least once at Finovate recently. If your mobile banking app has a credit/debit card on/off these are the folks behind this technology – I can’t think of a mobile banking vendor that does not work with Ondot.

VB is show a “smart gift card” via IOS app that is slick. While I’m a fan of prepaid cards I’ve been waiting for solution where it’s easier to have (and share) a prepaid card on my mobile. It’s got a great UI.

VB is show a “smart gift card” via IOS app that is slick. While I’m a fan of prepaid cards I’ve been waiting for solution where it’s easier to have (and share) a prepaid card on my mobile. It’s got a great UI.

There are a lot of cool things about Ondot and this innovation is just one of the innovations that are coming from this company.

Showing VB taking a selfie photo to approve the gift card pre-approval for both a gift card and a credit card. He created it in less than six minutes. Great job VB. ^William

Ondot has a strong value proposition for gift cards. For the gift sender, you get to keep the “breakage.” This means you only pay for the gift cards that get redeemed. For the recipient of the gift card, you receive a virtual card you can use online for ecommerce, as well as a means to use it for tap and pay in the real world. And for the retailer, this is a very novel solution that helps bring attention to their business.^SR

01:22 pm

Flybits https://flybits.com @FlybitsInc

Presenters:

- Justin Lam

- Hossein Rahnama

Info: Flybits’ turnkey solution uses data intelligence and contextual computing to implement a digital personalization strategy for retail banking, wealth management and insurance.

“Created a design tool to create off the shelf services for your customers.” Now speaking about talking the bank’s or FI’s legacy system – mainframe, call center, etc. so I’m assuming they have strong API’s and/or connect to Yodlee. Showing use case as Interest in EFT, Interest in Mortgages, Retirement Planning. Use machine learning to build an “experience” they call an “EFT nudge.”

Based in Toronto it looks likes they have raised about million in funding – last round Series B. From Crunchbase: “Flybits hides the complexity of data intelligence, enabling enterprises to create and deliver highly personalized customer experiences.” ^William

Based in Toronto it looks likes they have raised about million in funding – last round Series B. From Crunchbase: “Flybits hides the complexity of data intelligence, enabling enterprises to create and deliver highly personalized customer experiences.” ^William

Flybits has a platform for managing an array of microservices, building blocks that enable you to create new data-driven offerings. The Experience Studio has templates of applets that you can configure to engage with customers. ^SR

01:15 pm

Plynty

Plynty

@plynty

Presenters:

- Dennis Hooks

- John Getchell

Info: plynty’s mobile-first platform and application provide effective and engaging retirement and financial planning tools that deliver high-quality advice and a positive experience.

White label app for FI’s. They:

1 don’t give customers bad news

2 easy to download app

3 millennials make up 55% of their customers

Article of interest:

https://www.dailyworth.com/posts/three-retirement-planning-tools-you-need-right-now

They are building a retirement plan on a mobile phone with a GREAT UI. I’m pretty sure I’ve seen these folks before. They are doing a great demo. Most Millennials I know don’t want to do ANYTHING if they can’t do it on their phone. Great job.^William

As Americans, we aren’t very good at planning for the future. Plynty wants to make it easier for the mass of consumers to better plan for retirement. It is great if you can afford a personal financial advisor, but not everyone can. This solution hopes to democratize retirement planning. The first step is better planning how you use your cash.

As Americans, we aren’t very good at planning for the future. Plynty wants to make it easier for the mass of consumers to better plan for retirement. It is great if you can afford a personal financial advisor, but not everyone can. This solution hopes to democratize retirement planning. The first step is better planning how you use your cash.

The mobile app has an emphasis on cashflow planning. You can itemize expenses, determine your income, and figure out what you have available for savings. The demo of the app magically eliminated a 1% advisor fee, but not sure how that happened. Doesn’t look like they provide financial advice.

I’m generally pessimistic about savings/planning solutions. I just don’t think we’re all good at it, and don’t really want to change our ways. ^SR

01:08 pm

IdentityMind Global

http://www.identitymindglobal.com/

@IdentityMind

- Presenters:

- Faisal Nisar

- Rao Wu

Info: IdentityMind Global’s KYC plug-in uses digital identities to solve KYC compliance for business and compliance buyers at fintech companies.

DIGITAL Identities – KYC – I don’t know these folks but I’m looking forward to it. I haven’t seen a ton of KYC solutions of the past year or so.

Showing KYC web based form their platform, user can change the form as needed. Sidebar mentions KYC and ICO plug in. Now, that’s interesting. Are they going to show a browser plug in for KYC compliance for an Initial Coin Offering? That’s really new here.

Showing more customer data collection. Showing consent from customer related to EU regulations.

These folks are based in Palo Alto and have raised at least in VC so far. Last funding round was Series C.

I’m going to stop by their stand to learn more. ^William

——

The topic of digital identity is one of the most pressing in banking. Know Your Customer is a mantra, and a buzz word. But this process of authentication is cumbersome and creates a poor CX. These are some of the things they are hoping to address.

They are GDPR compliant, which is critical across Europe, but in the USA as well. This is becoming a global standard for managing data privacy.

A visual platform enables you to see trends and delve into potential hot spots. ^SR

12:59 pm

Stratyfy

Stratyfy

@StratyfyInc

- Presenters:

- Michael Cherkassky

- Laura Kornhauser

Stratyfy’s software uses a differentiated approach, powered by proprietary technology, to target unfairness and biases common in credit risk decisioning for consumer lenders.

Using AI with lending. I don’t think this is something I’ve seen at Finovate. Showing platform. “The most accurate models for credit decisioning with samples based on LendingClub loans.” They use AI for “rules mining”. Interesting. It’s a kind of complex demo but they are doing a good job. I would suspect this might be their first Finovate.

Folks, I like what I’m hearing and I’m believe that you do have a truley new lending platform with AI technology. I’m hoping to see an easier UI as we are watching the borrowers models. It’s really text based. I’m assuming since it’s web based it can be used on any kind of computer or tablet in any environment. Unless I see a mobile version it I think it would be hard to use on a phone. I want to learn more and I’m glad they are here. ^William

—–

Not all good borrowers have long credit histories. After 40 years, isnt it time for a new way to assess real creditworthiness? Stratyfy believes so, and they have a new way to evaluate credit risk using predictive analytics. A rules engine meets predictive analytics, like AI, but without the black box.

Not all good borrowers have long credit histories. After 40 years, isnt it time for a new way to assess real creditworthiness? Stratyfy believes so, and they have a new way to evaluate credit risk using predictive analytics. A rules engine meets predictive analytics, like AI, but without the black box.

From an analytics perspective, what Stratyfy is saying makes sense. The human-readable, editable, set of rules is critical. It is critical for banks to understand the decisions it is making, without the hidden bias that is possible in some AI solutions. ^SR

12:51 pm

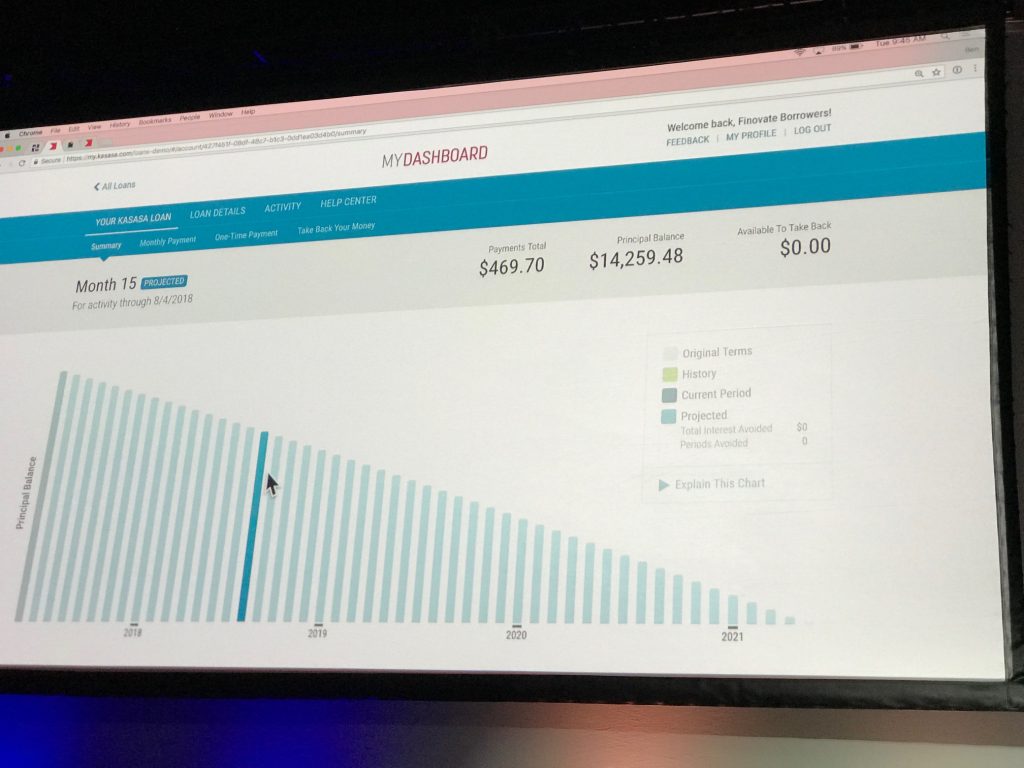

Kasasa

https://kasasa.com/

@Kasasa

- Presenters:

- Gabe Krajicek

- Chris Cohen

- Ben Morrison

Kasasa is the innovative leader in branded, community-powered banking products proven to drive profit and growth for community financial institutions such as banks and credit unions. (Full disclosure: William Mills Agency represents Kasasa.

Works with 800 banks, credit unions and other non-bank banks for retail banking products in all 50 states. Consumers biggest need is to get out of debt faster. Testing showed 87% preference for this product. Showing MYDASHBOARD show the consumer can see how their Kasasa Loan is doing at “Freedom Institution”. They are showing the ability to “Take Back” balance for consumers to get no fees for unexpected expenses. This is REALLY cool because so many folks need money they don’t have quickly and wind up paying a TON in fees and high rates. A Kasasa loan is a better way to lend. I like it and have not seen this approach from any other provider.

They are also launching their IOS version.

Great job guys! ^William

——

I have to admit, I love what Kasasa does. They enable banks of all sizes to apply technology for real financial services innovation, in a turnkey way. Banks can deploy sophisticated marketing and product solutions, without a massive investment of R&D

I have to admit, I love what Kasasa does. They enable banks of all sizes to apply technology for real financial services innovation, in a turnkey way. Banks can deploy sophisticated marketing and product solutions, without a massive investment of R&D

The team is announcing the launch of Kasasa Loan , helping people getting out of debt more quickly. The consumer-facing dashboard is extremely intuitive, and helps people to make better decisions about how they manage their money. In this demo, they show a consumer making a change to loan (getting more money), after it has already been underwritten. I’ve never seen this kind of after-the-fact flexibility. It is compliant in all 50 states, which is great.

There is a coming mobile app, co-branded with the bank or credit union where the consumer is a customer or member. Great way to compete for loan volume, without driving rates down

^SR

12:43 pm

Zuma Liquidity Solutions

https://zuma.global/zlsapp/#/register/investor

- Presenters:

- Ben Sullivan

- Vika Arkhipova

- Cisco Liquido

Zuma’s white-label invoice financing platform offers automated underwriting processes and lowers transaction costs for banks.

“Exela is NASDAQ traded, serving 150 FI’s, new product launch today with Zuma” (I think). I believe we are looking at a combo of an LOS and an accounts receivable (AR – think OnDeck) but we will learn more. Showing web-based workflow on example loan app using the “Zuma Credit Score” – can connect to variety of credit scoring systems – FICO, etc.

Showing OCR extraction of invoice (for a business advance?). Clean, easy to understand UI.

Showing white label dashboard for FI’s. I think this could be good thing for more FI’s to study. Most FI’s don’t have the lending platforms they need for 21st Century Lending, not to mention the financing invoice capability. Good job. ^William

—-

This is the launch of a new company, it helps businesses with financing of inventory. Businesses are definitely challenged to collect on those invoices! Winning the business for an SMB is just the start, the key is how to get paid, and get paid without having to wait up to 90 days to receive the money.

The platform also helps financial institutions with a white label solution to participate in this kind of marketplace. From the bank’s perspective, the Zuma product provides end-to-end functionality for lending. Cloud-based solution for SMB lending. ^SR

12:06 pm

Good day! Welcome to FinovateSpring 2018. I’m here at the Santa Clara Convention Center getting ready for the demos to start.

In addition to two great days of demos I’m looking forward to days 3 and 4 of conference content and a panel session I’m hosting on Friday.

This is either my 21st or 22nd Finovate; I’m not sure. I’ve participated in every US event except one as well as Finovate Europe last year. There are a number of great events in FinTech but this one I do my best to attend each year.

If you are here at the conference feel free to stop by at the breaks, I’m on the front row or email me at william@williammills.com.

William Mills, CEO

William Mills Agency

North America’s Largest FinTech PR and Marketing Agency

+1 678 694-7213

@williamemills

@wmagency

——

Fintech has become so popular it is now a household word. Well, maybe only if you live within 50 miles of Silicon Valley, New York, London, Hong Kong… But fintech has become a global phenomenon as we witness the technology-driven transformation of financial services including banking, payments, insurance, capital markets, and wealth management. At the dawn of an earlier era, the Finovate conference was there to kick the tires on the latest in financial technology and innovation. Now some many years later, Finovate is still the place where nearly 1,500 people gather to experience the cutting edge. We’ll be blogging live, with near real-time commentary on over 70 companies over a two day period. Buckle in, refresh this page from time to time, and don’t forget to follow us on Twitter @beyondthearc . ^SR

William Mills III, Chief Executive Officer of William Mills Agency is live blogging today at FinovateSpring 2018. He has more than 34 years of experience in financial technology and is a recognized leader in financial and technology marketing. He has personally advised more than 300 chief executives on marketing strategy, business development, mergers and acquisitions, company branding and public relations. You can contact him via email at william@williammills.com or on Twitter @williamemills.

Steven J. Ramirez is CEO of Beyond the Arc, Inc. Harnessing data science and deep marketing expertise, he and his team deliver analytics-driven Customer Experience solutions. Their work includes strategic initiatives at a Top 5 US bank where they directly improved Customer Experience through communications. Helping financial service clients create rapid wins through intensive data strategy and improved customer engagement is their specialty. For more information about Beyond the Arc visit beyondthearc.com, call 1-877-676-3743, or email web@beyondthearc.net. Insights on social media, financial services and more are shared on their blog, or follow them on Twitter at @beyondthearc. ^SR